Green Shoots in the Natural Gas Market

It’s no secret that the oil market is in turmoil. COVID-19 related travel restrictions have destroyed oil demand and producers have struggled to deal with low (or even negative) pricing. Even the recent uptick above $30/B is only enough to keep the lights on for most producers. But there may be a silver lining; while the screens of oil traders are flashing red, green shoots are emerging in the natural gas market.

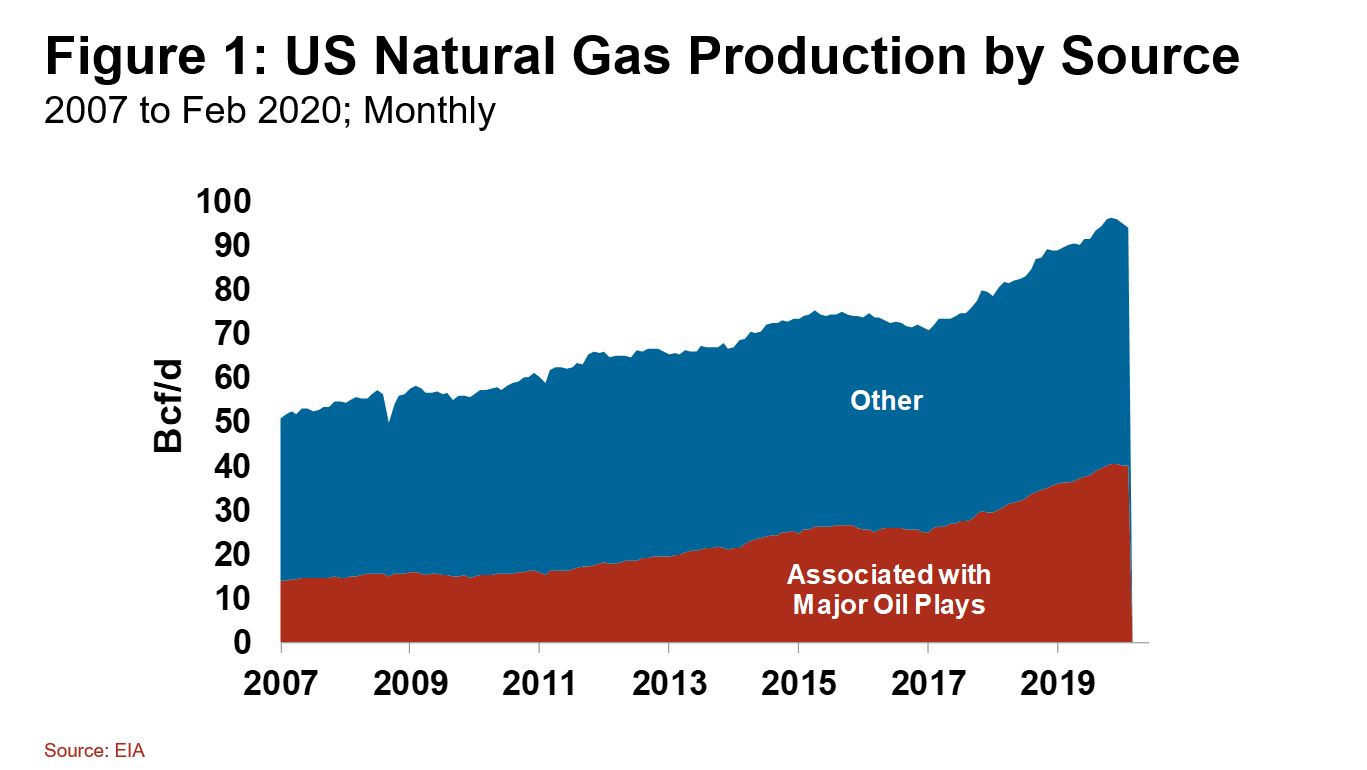

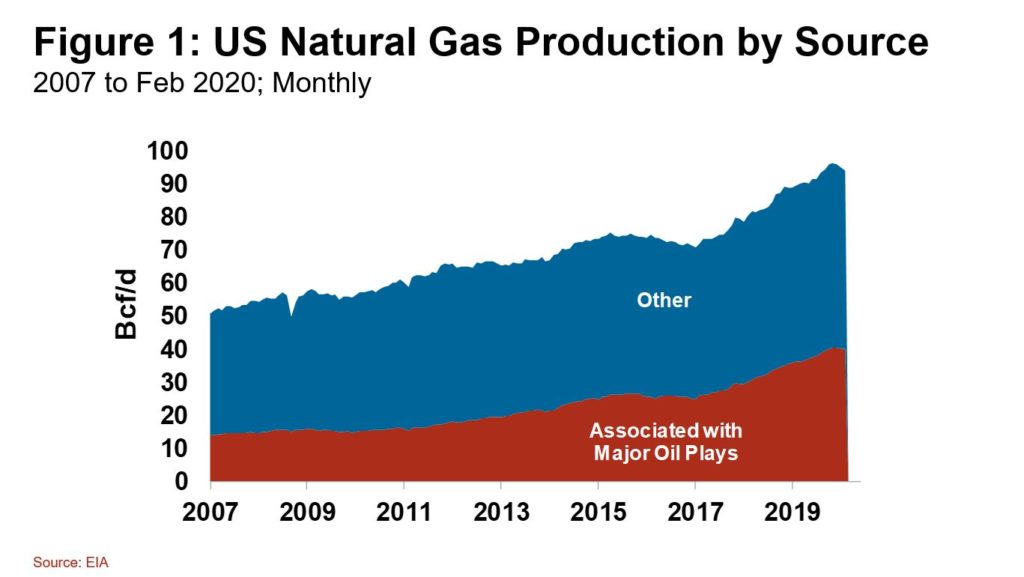

For the last several years, a large share of the growth in North American gas production has come from associated gas; the gas that is produced as a by-product of oil production. As the United States grew to become the largest producer of oil in the world, the production of associated gas also surged. As of February, more than 40 Bcf/d of natural gas was coming from the major US oil plays, over 40% of the total (see Figure 1).

Because associated gas is produced alongside oil, drillers aren’t nearly as focused on the prices they receive for it. Many oil producers previously could still make money if they sold their gas for zero or even negative prices, as they often did in the Texas Permian Basin. This associated natural gas production then crowded out other sources of gas supply that rely on higher prices to remain economic. After–all, it’s hard to compete with someone who makes their product for free.

At the start of this year, the trend was expected to continue. Growth in oil production would bring yet more associated gas, oversupplying the market and further weakening natural gas price.

Enter COVID. With the world of oil flipped on its head, the old forecasts have been thrown out. Instead of growing in perpetuity, US oil production is now expected to fall, and fast. Production is already retreating due to short-term shut-ins, but the lasting drop will come when the existing tight oil wells continue their steep declines without enough new drilling to offset the reduction.

Associated gas will fall as a result, creating a hole that will need to be filled by more gas-directed drilling. But current gas prices are not much of an incentive, as evidenced by the record low number of rigs targeting dry (unassociated) gas in the US. Prices will have to rise in order to incentivize new drilling in the major gas plays, the Marcellus, Utica and Haynesville. However, with corporate balance sheets in distress, and many investors hesitant to invest in energy, the big question becomes: just how high will gas prices need to rise before the rigs start heading back into the gas fields?