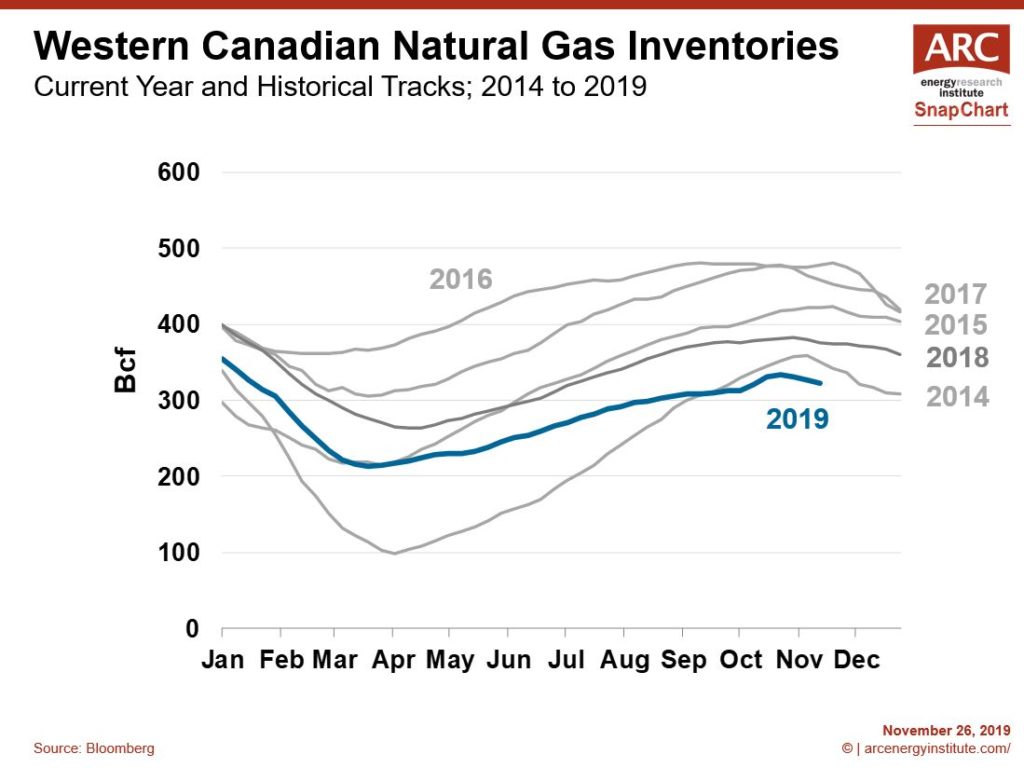

SnapChart – Taking Stock of Natural Gas Inventories

As we turn the page on November, and look ahead to the winter with memories of last February still frostbitten into our minds, now is a good time to take stock of Western Canada’s natural gas inventories.

Inventories are low. Really low. That’s what our year-over-year wrap chart this week shows. In fact, natural gas caverns haven’t been this empty in November since 2006. This could set the market up for higher prices, especially if the winter is cold.

So what got the market to this place? The freezing cold weather in February certainly contributed; as consumers burnt more gas to warm their homes, domestic inventories drew down at a much faster pace than usual. But there is more to this story.

In years past, the market would have responded to the winter drawdown; upon seeing low inventories and a risk of price spikes in the coming winter, storage operators would have frantically injected gas during the summer months. That’s what happened in 2014, a year that started injection season with less than half the gas in storage of this year, but still managed to end the season above current levels.

The biggest difference between 2014 and 2019 is access to storage. Since July of 2017, TC Energy has been employing a policy on its Alberta natural gas gathering system that prioritizes firm service during maintenance periods, causing the capacity available for storage injections to be constrained. Back in 2014, storage operators could inject gas whenever the economics worked. For much of this year, however, storage access was simply unavailable no matter how low gas prices fell (and fall they did).

After long negotiations, the policy was changed in late September on a temporary basis – for the month of October 2019 and starting again in spring of 2020. October gave a sneak preview of the impact of this policy change and it was supportive for both pricing and storage injections (note the October uptick on the chart). Although welcome, several weeks of increased injections could not make up for an entire summer of minimal builds, and as such storage caverns are poorly supplied in advance of winter.

Low inventories create the potential for higher prices, potentially much higher in a colder-than-normal winter. There’s not much risk of Western Canadians “freezing in the dark,” instead an overly frosty winter would force consumers to bid back gas that was destined for export markets, at a significant price premium. As winter ends and the market enters into the lower demand spring and summer months, access to storage should provide a floor under gas prices, preventing those dreaded zero price days. Altogether there is a case to be made for decent pricing throughout next year.

The futures market has started to reflect this shifting dynamic, with 2020 gas at AECO now trading 20% higher than three months ago. Gas producers in Western Canada are battle weary from ultra-low prices, and there are admittedly still challenges ahead. But low storage levels and supportive policy are giving some cause for greater optimism in an industry that sorely needs it.