SNAPCHART – CANADIAN PENTANE & CONDENSATE PRODUCTION KEEPS MOVING UP

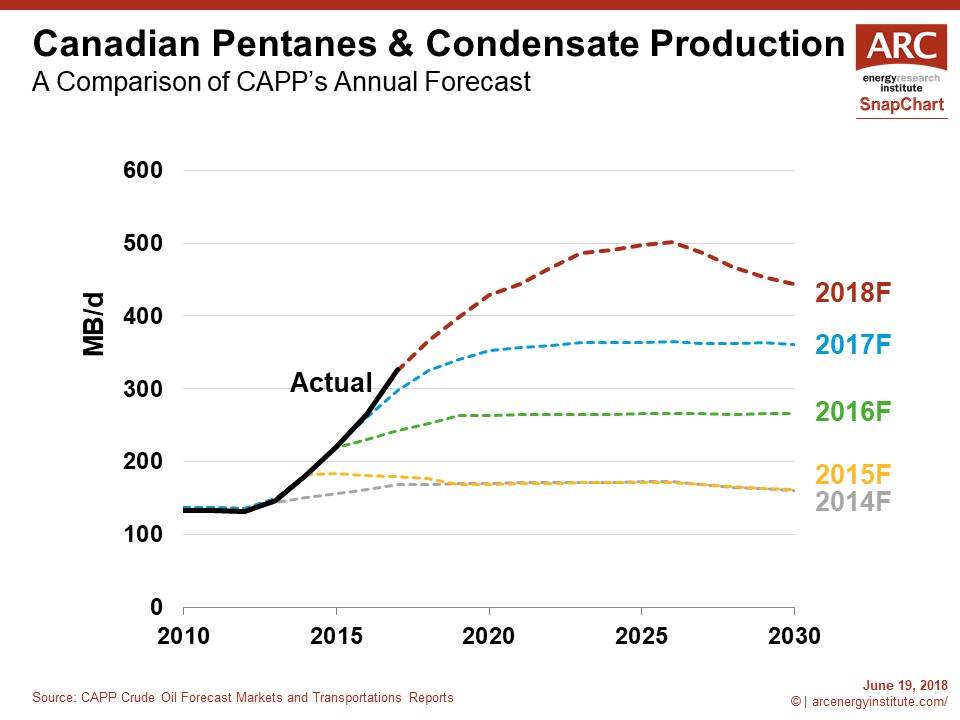

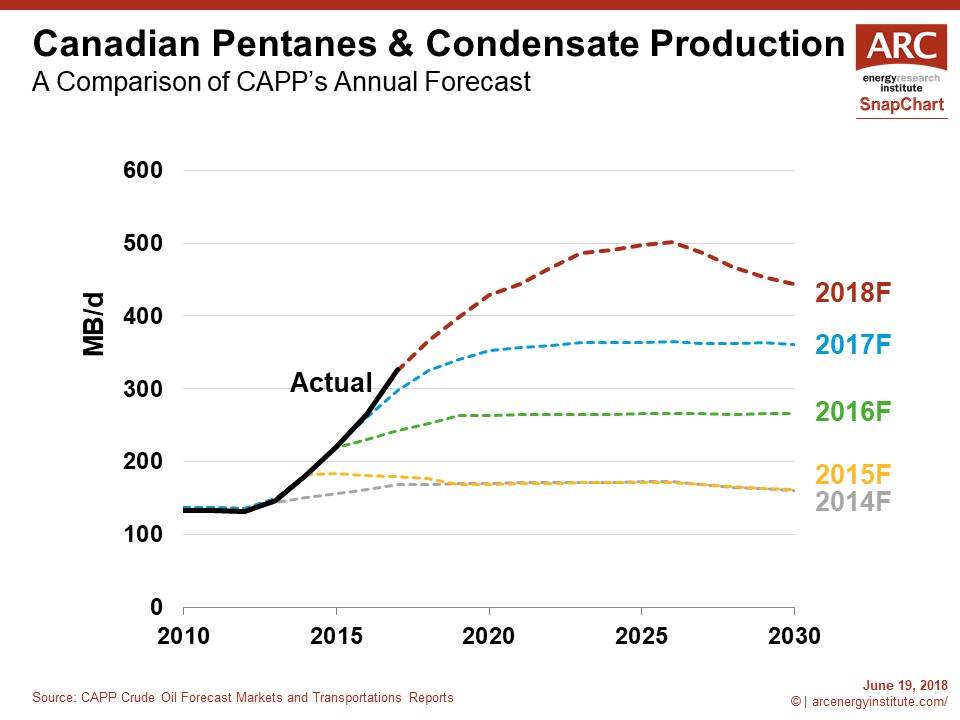

The closely watched annual Canadian Association of Petroleum Producers (CAPP) Crude Oil Forecast was published on June 12th. This week’s SnapChart compares the last five editions of CAPP’s outlook for Canadian light liquids, otherwise known as pentanes and condensate in their report. These products are lighter than crude oil and are in the same density range as gasoline.

In each of the last three reports, CAPP has boosted their light liquids outlook by about 100,000 B/d. These are not insignificant upward revisions. By comparison, consider that the oil sands industry has averaged 150,000 B/d of year-over-year production growth over the past decade.

Light liquids growth is coming from Canada’s emerging resource plays, mostly found in the northwest side of Alberta and over the border into northeast British Columbia. Because of ongoing innovation in drilling and completion methods, Canada’s oil and wet gas wells keep beating the forecaster’s expectations

Commodity price is another factor supporting production growth. While Canadian heavy oils have faced markdowns owing to a lack of pipeline capacity, Canadian condensates have been trading at a slight premium to typical levels. The light barrels are now priced at over $C 80/B, a threshold last seen in 2014. One reason condensates fetch higher prices is because they are not sold into the export markets, instead they are consumed locally by the oil sands for thinning the extra heavy oil.

Canadian resource plays are demonstrating robust economics – supported by innovation and higher commodity prices. As a result, spending in the non-oil sands sector is expected to top $C 30 billion this year. To put that number into perspective, oil sands spending was $C 34 billion annually at the peak in 2014 (but has since dropped to $13 billion). This year Canada’s resource plays will reinvest all their internally generated cash flow and more into new investments, a validation of the compelling economics at today’s price levels.

Considering the amount of capital investment in Canadian resource plays, robust commodity pricing for light products and the potential for more productivity gains, it is likely that CAPP will make another upward revision to their pentane and condensate production outlook next year.