Commentary – Cautious Optimism at CERAWeek

Source: ARC Energy Research Institute

Last week, the global energy industry gathered in Houston, Texas for the annual CERAWeek conference. Compared to last year – when the price of oil was near $US 30/B – the industry’s mood was cautiously upbeat. Here are the major themes that dominated the discussion:

1. Returning to cautious growth. After many quarters in the red, higher oil price and lower costs are healing corporate balance sheets. As a result, companies are starting to generate free cash flow and increase spending. However, corporate leaders are not planning on returning to the overspending habits of a few years ago; priorities include spending within cash flow and reducing debt.

2. Hoping for a higher oil price, but not planning for it. Most conference speakers believe that longer-term (perhaps in the early 2020s), the industry’s underinvestment will turn the oil price upward. In the meantime, corporate leaders are preparing their companies to survive and thrive in a lower price world.

3. Break-even cost estimates move down, again. Thanks to cost cutting and innovation, oil executives assert they have a list of projects that make economic sense, even at $US 40/B. While the majority of the low cost opportunities are found in the prolific North American tight oil plays, other low cost destinations are emerging. Slimmed-down offshore project designs are making some seaward projects competitive in the forty dollar range. Likewise, executives report that some onshore international developments can compete too.

4. “Permania” takes hold. The recent buying frenzy in the nearby Permian basin was a frequent topic of discussion. Are the land prices on recent deals too high? How many horizontal “benches” of resource does the play have? How much infrastructure will be required? Today, the play produces just over 2 MMB/d of oil and almost 8 Bcf/d of gas. Some at CERAWeek predicted that oil output could eventually reach 4 or 5 MMB/d. Pioneer’s Executive Chairman of the Board, Scott Sheffield, was more optimistic, forecasting that Permian oil production would reach 8 or 10 MMB/d with 20 Bcf/d of associated gas by 2027.

5. Peak oil demand is not on the horizon. Despite growing electric car sales, oil executives are not predicting peak oil demand anytime soon. Considering the limited alternatives to petroleum for trucking, heavy-duty hauling, shipping, aviation, petrochemical and other uses, it was argued that demand will keep pushing upward. Fatih Birol, Executive Director of the IEA stated, “If every second car sold was an electric car… we will still see global oil demand increasing.”

6. Technology upside. While innovations in hydraulic fracturing and horizontal drilling were a frequent discussion topic, the future potential for using big data and automation stole the show. Today, only a fraction of the many terabytes of data collected on wells and fields is used for real-time decision making. If all of the data could be integrated and made available to humans and supercomputers alike, operations would become more efficient. Similarly, oilfield automation is in its infancy. By applying technology used in other industries a step change in oilpatch efficiency is possible. Anadarko’s CEO, Al Walker, said it best, “We need to be more like Silicon Valley.”

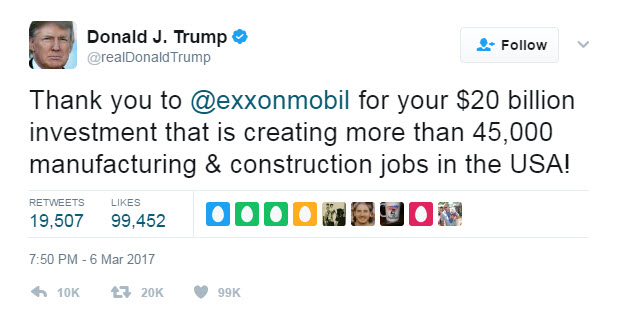

7. White House predictions. Shortly after Exxon announced plans to spend $US 20 Billion in the US Gulf Coast over the next ten years, President Trump tweeted his support. Speakers predicted that the pro-business and pro-industry White House could simplify and streamline regulatory approvals. However, the ultimate impact was debated; state-level requirements and legal challenges could still delay project timelines. As for changes to trade deals and border adjustment taxes, numerous concerns were raised. Worries included the possibility of negative impacts for global oil and gas producers and the potential for barriers in selling US gas to Mexico.

8. Canadian representation. Canada had the opportunity to champion the country’s oil and gas industry and investment strengths on the world stage. Premier Rachel Notley spoke on Alberta’s climate plan; Federal Natural Resources Minister Jim Carr highlighted the importance of Canada growing its access to international markets and Prime Minister Justin Trudeau received an award for Global Energy and Environmental Leadership at the conference. In his keynote address, Trudeau described the positive attributes of Canadian oil and gas, including energy security and reliability. Trudeau stated, “No country would find 173 billion barrels of oil in the ground and just leave them there.”

8. Canadian representation. Canada had the opportunity to champion the country’s oil and gas industry and investment strengths on the world stage. Premier Rachel Notley spoke on Alberta’s climate plan; Federal Natural Resources Minister Jim Carr highlighted the importance of Canada growing its access to international markets and Prime Minister Justin Trudeau received an award for Global Energy and Environmental Leadership at the conference. In his keynote address, Trudeau described the positive attributes of Canadian oil and gas, including energy security and reliability. Trudeau stated, “No country would find 173 billion barrels of oil in the ground and just leave them there.”

After a tough three years, the conference speakers confirmed that the industry is on the mend. While there is optimism, even excitement, about the cost cutting innovation that has made some projects economic at lower oil prices, the industry is still fiscally cautious. This fiscal conservatism will limit how many low cost projects can be sanctioned, and ultimately it will constrain how much US and other non-OPEC production can grow.