Commentary – Accounting for Future Carbon Risk in Crude Oil Investing

There is a great debate going on about investing in oil. Some say the risks of climate change are so urgent that investors should start divesting of their fossil fuel assets immediately. Aside from moral suasion, the economic argument is that today’s reserves-in-the-ground will soon become tomorrow’s stranded assets. However, some important economic factors are being overlooked in the stranded asset debate.

The divestment movement started to gain traction around 2011, led by de-carbonization think tanks, off-fossil-fuel organizations and campus movements. Today, the discussion of the implications of greenhouse gas (“GHG”) emissions on climate change and long term investment returns has shifted from the fringe to mainstream. Institutional investors including pension funds, university endowments, and large asset management groups are all asking oil and gas companies to disclose more carbon accounting information.

Over the past two years shareholders have requested greater climate risk disclosure from companies such as: Suncor Energy, Cenovus, ExxonMobil, Chevron and Occidental Petroleum. In turn, investors and corporations are voluntarily reporting their carbon exposure through initiatives such as: the Principles for Responsible Investment, the Carbon Disclosure Project, and the high profile initiative of the Financial Stability Board’s Task Force on Climate-Related Financial Disclosures, which was chaired by Michael Bloomberg and submitted recommendations at the G20 Summit in July 2017.

When thinking about the future of oil investing and financial risk, investors should consider that oil consumption is expected to remain relatively high; even after assuming that worldwide climate change goals have been achieved.

Consider the International Energy Agency’s (“IEA”) 450 Scenario. This scenario assumes aggressive changes to global energy supplies in order to constrain long term warming near 2° Celsius. Under this 450-compliant scenario, the IEA estimates that global oil demand would drop from 95 MMB/d today, to 73 MMB/d in 2040 (excluding biofuels). While consumption would be less than today, 73 MMB/d is still a significant amount of petroleum. Consequently, 25 years from now there would still be many companies, owned by shareholders, needed for meeting this still-sizeable level of consumption.

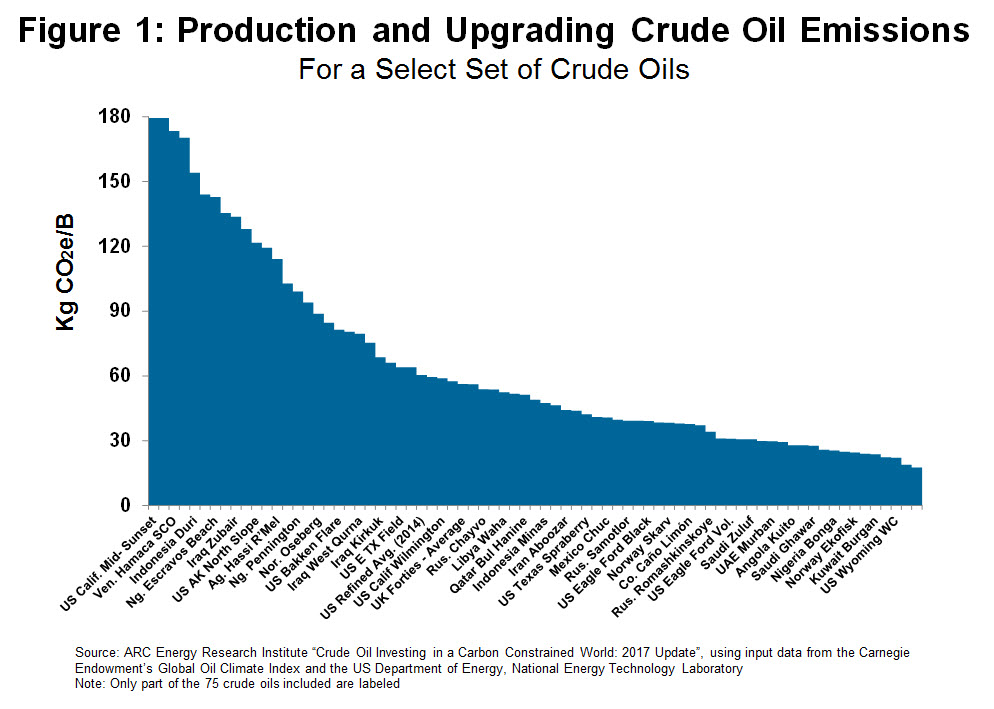

Informed investors should also consider that not all crudes oils are equal in their level of carbon risk. Figure 1 compares the GHG production and upgrading emissions for 75 different crude oils from around the world; from light oils in the Middle East, to hydraulically fractured oils extracted from Texas.

There is a wide, four-to-one range of carbon intensities between high and low carbon crude oils, and as a result, financial risk is not distributed equally between all equity investments in oil companies. For instance, assuming a carbon levy of $50/tonne is applied for emitting carbon dioxide and other GHG gases, then the lowest carbon crude oils would face an additional $1.50 per barrel of cost, while the highest carbon crudes would incur up to $6.00 per barrel of extra costs.

There is a wide, four-to-one range of carbon intensities between high and low carbon crude oils, and as a result, financial risk is not distributed equally between all equity investments in oil companies. For instance, assuming a carbon levy of $50/tonne is applied for emitting carbon dioxide and other GHG gases, then the lowest carbon crude oils would face an additional $1.50 per barrel of cost, while the highest carbon crudes would incur up to $6.00 per barrel of extra costs.

As counterintuitive as it seems, lower carbon oil producers could actually benefit from more stringent GHG policies. This is because these producers could realize benefits relative to their higher carbon peers; such as: higher demand for their products, lower energy use in their operations, and reduced operating and carbon compliance costs. Another way to think of this is that carbon levies will amplify the competitive advantage of oil companies producing lower-carbon-intensity hydrocarbons.

To enable investors to differentiate between lower and higher carbon crude oils, the ARC Energy Research Institute has recently published “Crude Oil Investing in a Carbon Constrained World: 2017 Update.” The report is a “How to Manual” for investors to estimate the GHG emissions from any oil field, providing them with the information they need for testing the implications of future carbon policy on their investment returns. Through the process of modeling and measuring emissions, opportunities for reducing GHG emissions can also be identified.

Finally, investors should factor-in the dynamic nature of the oil and gas business. Crude oil carbon intensities will not remain static over the coming years and decades. Forward-looking oil producers are already innovating to reduce their carbon intensities, with demonstrable improvements. By lowering their emissions, producers are already reducing future policy risk for themselves and their investors. In doing so, these progressive companies are also part of the solution to address climate change.

Divestment movements have stimulated a mainstream push for the world’s most sophisticated investors to demand greater climate change risk disclosure. As a consequence, companies producing progressively lower-carbon oils will gain a competitive advantage that will be attractive to investors while contributing to the necessity of lowering future emissions.