Commentary – Demand: The Bright Spot in Today’s Depressed Oil Markets

Although there is wide disagreement on the future price of oil, there are some facts that almost everyone can agree on. First, that oil is an essential commodity (validated by the 94 million barrels of oil consumed in the world each day). Next, that economic growth drives oil demand in a reasonably predictable manner. And finally, that demand for a product increases when price drops.

Considering these demand principles, increasing oil demand this year seems a given. Despite the doom and gloom fog that never seems to lift from the business headlines, the global economy is still expected to expand by 3.3 percent, and the energy intense developing economies are expected to grow by 4.2 percent. The prospects for economic expansion are improved by low oil price. But despite the signposts for strong oil demand, earlier this year, experts remained cautious. Their concerns were twofold. Firstly, that a recession for crude oil exporters, like Russia, could lower the amount of oil demand from those countries. And secondly, for some consumers, despite lower oil price, the retail price for gasoline and diesel was expected to remain high. Their logic was that the combination of a higher valued US dollar and government tinkering with fuel subsidies would cancel out most of the benefits from low oil price.

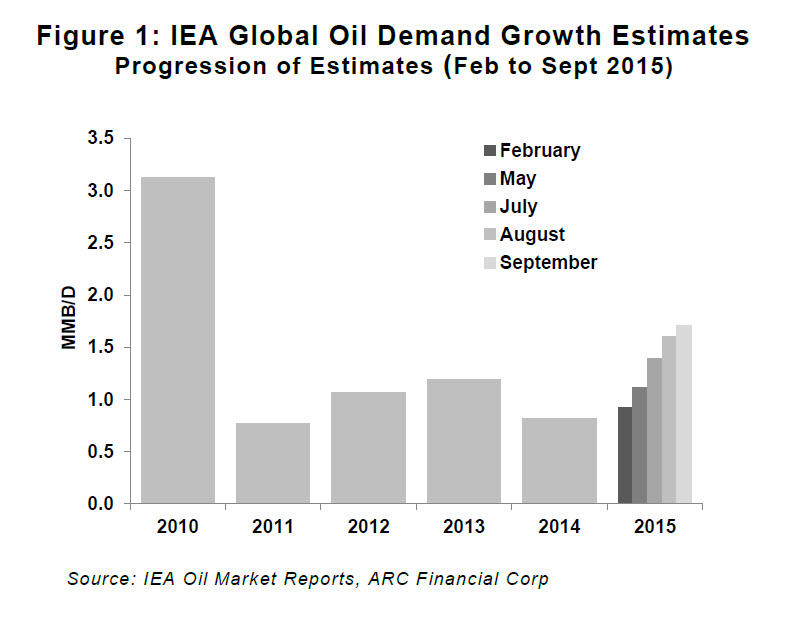

But, despite these headwinds, the principles of oil demand are prevailing. The current IEA outlook is that oil demand will increase by 1.7 million barrels per day in 2015, almost two times higher than expectations at the start of the year and the highest level in five years (see Figure 1 for the history of oil demand growth and the upward progression of the IEA estimates for 2015). This year’s rise in oil demand is made-up of four equal pillars: China, the United States, other growth economies in Asia (for example India), and everywhere else.

Despite a volatile stock market and weaker economic data, Chinese oil demand has been robust so far this year. According to data from the IEA, first half 2015 oil product demand was 5.2 percent higher than the same period last year. Demand has been inching up as a result of government infrastructure spending and Chinese interest rate cuts. But while the headline numbers still look healthy, the make-up of Chinese oil demand is shifting along with the country’s economy, from industrial driven to consumer driven growth. This is illustrated by the fact that diesel fuel consumption so far this year has been flat, while the use of gasoline has been rising.

Last year, US oil demand was at the same level as in 2010. Flat US oil demand has mostly been the result of a sluggish economy and government policy that substituted petroleum for biofuels. Considering the historically flat profile, it may come as a bit of a surprise that growth in US oil demand will be on par with China this year. But, as economic theory predicts, Americans are driving more when fuel is cheap. So far this year, the price for gasoline has averaged 28 percent lower than the same period last year, and the miles travelled by American vehicles are 3.6 percent higher. While part of the new oil demand is the direct result of cheap pricing, higher employment is also a cause. According to data from the US Bureau of Labor statistics, the US economy has added almost two million jobs since the end of last year, and consequently many more people are commuting to work.

Excluding China, other non-OECD countries in Asia have also driven demand higher. This group includes countries like India, Indonesia, Philippines, Pakistan, and Thailand. New demand from India alone is expected to make up 40 percent of the total for this group. Undoubtedly, if the Chinese economy slowed, there would be knock-on effects for this group. However, not all of the demand is dependent on China.

The last source of new oil demand is from everywhere else, mostly from the Middle East and Africa. Despite fiscal strain from less oil revenue, consumption of oil in the Middle East oil is still expanding, albeit at a slower pace than last year. African oil demand growth has sped up this year compared to last.

Demand is an under-appreciated bright spot in today’s depressed oil markets. In the constant chatter, supply-side questions dominate the discussion. For instance, what will be the future trajectory of US oil production? Or, how much more oil can Saudi Arabia or Iraq produce? But while the world has been focused on the supply glut, the previously mentioned demand principles have been quietly working in the background. Even though the oil market is still fundamentally over supplied, the glut would last much longer if demand were not growing at a pace not witnessed in many years. And while China still matters, oil demand this year is not just about one country. So while there are a range of views on the future of oil markets, there is one thing that everyone should be able to agree on, the world’s appetite for oil still is growing.