Commentary – Don’t Underestimate Canadian Shale Gas

As published in Grande Prairies’ Daily Herald Tribune, June 11,2015:

Here is an interesting, yet little known fact: The production growth from Western Canada’s natural gas shale plays is comparable to that of the oil sands. Between 2009 and 2014, Western Canadian shale gas and associated liquids grew by about 700,000 barrels of oil (equivalent) per day, while the oil sands grew by 800,000 barrels per day.

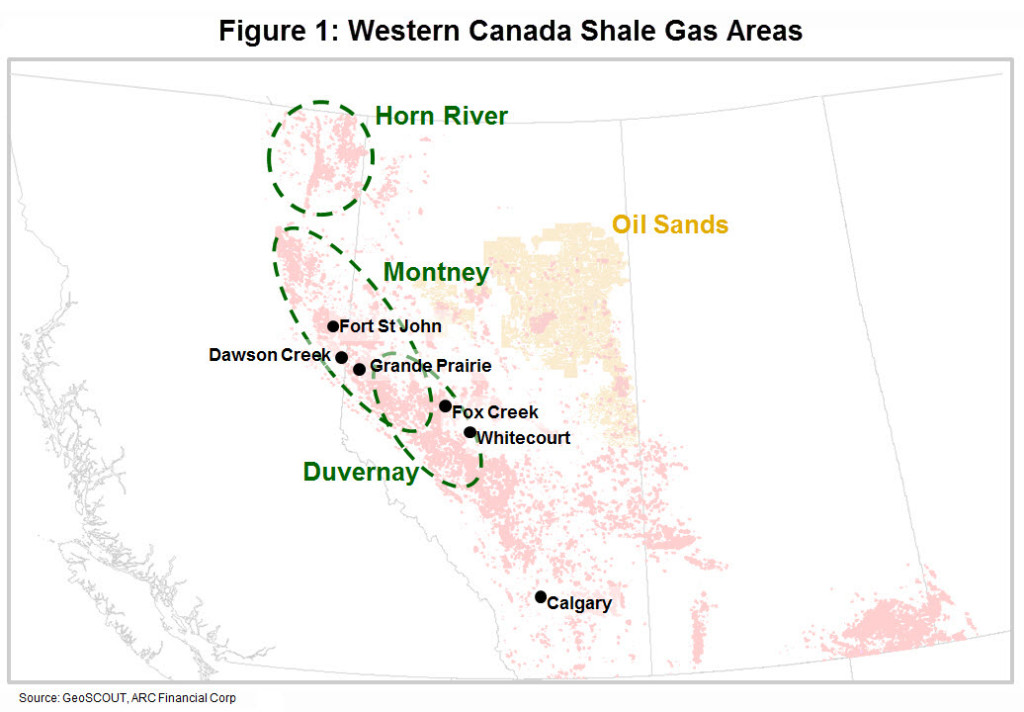

Much of the shale gas expansion is unfolding in Grande Prairie, Alberta’s lesser known energy boomtown. In addition to Grande Prairie, other centers for shale gas development in Western Canada include Whitecourt, Fox Creek, Dawson Creek and Fort Saint John.

While the story of the oil sands development is well known, the shale gas story is one that has not fielded the same attention. Buried deep beneath the earth’s surface, shale rock and natural gas are bonded so tightly together that the gas was for many decades widely believed to be too difficult to recover. However, around 2007, the combination of horizontal drilling and hydraulic fracturing, allowed American producers to have success in freeing natural gas from the shale rock. Only a few years later the technique started to take off in Western Canada. Today, Western Canadian shale gas is produced from the Horn River play in the Northeast corner of British Columbia, the Montney play that centers on Grande Prairie, and the Duvernay play that extends from Grande Prairie south past Fox Creek. (see Figure 1)

One reason that shale gas development has been less recognized is, that despite its growth, overall Western Canadian production has barely grown since 2009. Prior to the discovery of shale gas, Western Canada relied on conventional production. However, low natural gas price has made this old-style of production unprofitable and the conventional wells are declining as a result. Without the new shale gas production to offset the decline from aged conventional wells, Western Canadian gas production would be about 30 percent smaller than today.

Compared with oil sands development, another reason why shale gas’ growth has been less recognized is the smaller scale of each investment. While oil sands projects issue press releases announcing billions of dollars of spending, an individual shale gas investment is smaller. However, in aggregate, shale gas spending adds up. When touring around Grande Prairie, it is hard to deny that billions of dollars of investment has taken place here. The region’s highways are now bordered with miles of equipment yards, housing an assortment of costly oil and gas service equipment – such as massive pumping trucks, service rigs, drilling rigs, piles of pipes, and storage tanks of all types. New camps in the shale gas fields house workers from all corners of Canada. The grain elevators that are interspersed on the railway lines are now making room for sand elevators (that store sand for use in the fracking process) and new crude oil loading terminals ( that move light crude oils and other natural gas liquids that are valuable byproducts of shale gas). And even though the recent downturn in oil and gas price has dialed down investment, so far, shale gas spending is holding up better than most other types of oil and gas.

The next time you hear about the economic benefits from the oil and gas sector in Canada, be sure to point out the contribution of the shale gas plays surrounding Grande Prairie, which have pumped out new energy at a comparable pace to oil sands.