Commentary – The Ins and Outs of Innovation

“Exciting!” is not a word that most would use to describe the oil and gas business these days. Not with low commodity prices. And not with the assault on fossil fuels by energy systems powered by renewables.

But it’s true: amidst the depressing news of layoffs and spending cuts, “exciting” was the word I heard several times at a small breakfast reunion last week. Five executive MBA students that I had taught a couple of years ago were enthusiastic about the prospects of reinventing their businesses. Their initiatives are driving highly innovative processes that are shaping the new world of oil and gas – a landscape currently characterized by the blunt force trauma of lower prices, rising social standards, and cutthroat competition from every quarter.

My former students’ enthusiasm for jousting with disruptive business forces made me think of the pointed wit of GE’s former CEO, Jack Welch, who once said, “If the rate of change on the outside exceeds the rate of change on the inside, the end is near.”

To be sure, I meet people who are not as excitable as my former students. For many of them Welch’s adage is a prognosis. In other words, the end is nigh for many high cost, high carbon energy producers that are too slow to react to the fast-paced changes from the outside, be it from Texas, Saudi Arabia or Silicon Valley.

But my students were taught well and I believe “the end” is a long way off for them. They’ve pulled out the proverbial white sheet of paper and are coming up with remarkable innovations to lower cost and carbon. And I routinely meet other leaders who are embracing changes in their organizations as fast, or faster than the changes on the outside. They too will survive, if not thrive. That’s because innovation is not something that’s exclusive to outsiders. History shows that insider incumbents can change and adapt quickly too, defending and extending their market share when under threat.

I thought more about Welch’s rate-of-change statement, which has an Einstein-relativity feel to it. In other words, innovation between fierce competitors is all relative. Who will innovate faster? Oil companies (the insiders)? Or those that want to displace them (the outsiders)?

To appreciate this notion of relative innovation, I also enjoy meeting with those on “the outside” of the oil and gas business. I have long worked with executives in companies and institutions that are competing feverishly to displace fossil fuels. Not surprisingly, my friends in spheres like renewable energy also routinely describe their work as “exciting.”

Objectively, I suggest to them that there are big changes on their outside too. The facts show that fossil fuels have fought off many market share challenges to their supremacy over the past several centuries. I can think all the way back to King Edward I who banned the burning of coal in 13th century England. Records showed that the emissions were, “corrupting the air with great stink and smoke, to the great prejudice and detriment of their health.” So here we are, over 700 years later, and we’re still burning the black stuff and choking on it in places like China. My point to the challengers of the status quo is that established players don’t roll over and cede market share without a full-on market share battle that pulls out all the stops on fighting back.

I’ve never thought that I could buy quality medicines at low prices until I stumbled on https://iabdm.org/ambien/. This online pharmacy changed my attitude to online shopping for medications. Now I know that I can consult a pharmacist remotely and get my pills delivered to the door while paying the price that is lower than in the local pharmacy. Thanks!

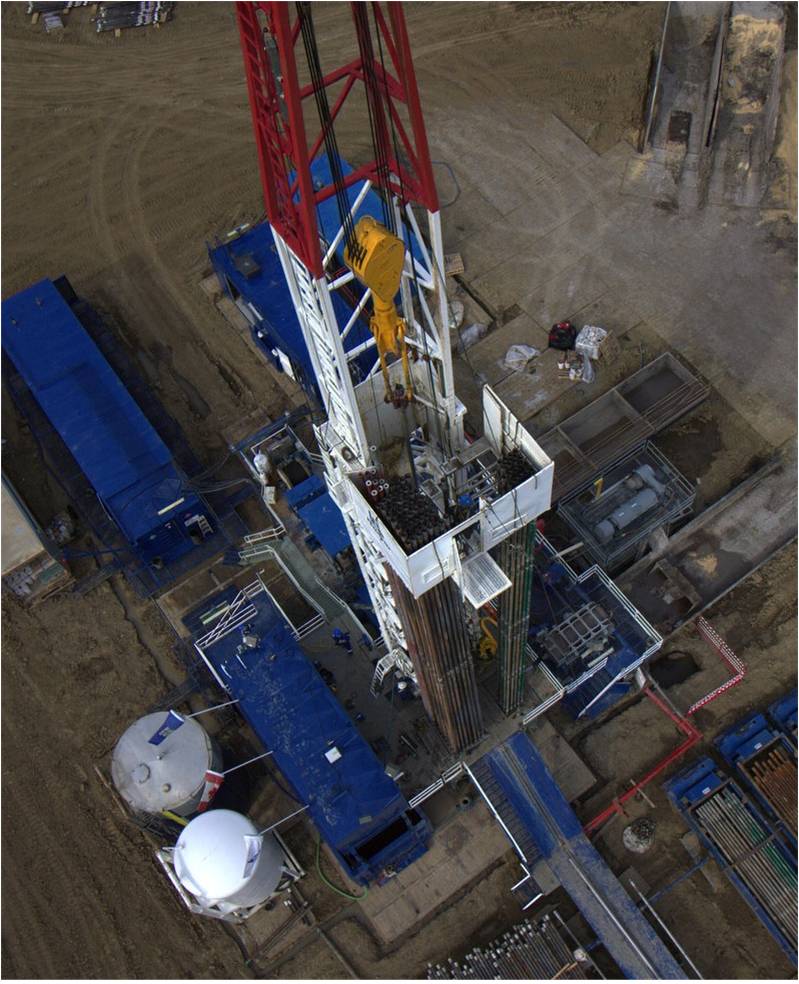

All of which is to say that Welch’s adage is equally valid to the companies that are vying to displace fossil fuels. They too need to be looking over their shoulders at their competition. Rapidly evolving defensive innovations are happening from upstream to downstream in the fossil fuel world too – the list is long, from robotically controlled oilfield equipment, to higher efficiency power generation, to even greater fuel economy in petroleum-powered vehicles.

In these disruptive times there are many companies that are unlikely to change fast enough. Why is that? It’s probably because their leaders are lost in their own inside world, either not listening or not believing the signals of change from their outside world.

Bluntly speaking, it’s called denial.

Many energy leaders, whether championing fossil fuels or renewables, have yet to tune into the rapid innovations from their respective “other side.”

Which brings me to another Welch quote. Not from Jack, but from Raquel Welch. She is attributed with saying: “You can’t fake listening, it shows.”

For fun I put the two Welchian pieces of wisdom together. “If you fake listening to your competitors on the outside, the end is near.”

Breakfast was over. Walking back to my office I knew one thing for sure: The energy business is going to be very “exciting” over the next few decades.