Commentary – Oil Price Outlook: The View From the Bar

An economist, a business school professor and a physicist walked into a bar.

They ordered a round of drinks. The bartender smiled and asked, “Is this like a three-guys-walked-into-a-bar joke?”

Nobody laughed. Televisions were tuned into a headline news feed talking about oil prices. Eyes were glued to a chart showing how a barrel of West Texas Intermediate had risen over 25% in the past six weeks. The question on the nacho plate was simple: Where are oil prices going?

Sheila, the economist gave her assessment. “Oil prices were too low,” she said, “$30 for a barrel of oil is well below the marginal cost of finding meaningful new reserves and bringing them onto production, so is $45.” She continued with some theory, “General equilibrium occurs when price equals the cost of bringing the last barrel consumed out of the ground.” Sheila’s punch line came next, “The problem is that supply can’t respond as fast as demand – the two sides are not reacting to price signals sympathetically, both are always out of sync. Over the next year oil prices are going to go much higher, pushing through general equilibrium.”

The other two nodded.

“I’ll take the finance and strategy view,” said Aaron the business professor, “Global upstream investment is down by 45% since 2014 – not good for a capital intense business that relies on steady drilling to keep supply flowing.” Tapping his credit card on the table, he said, “There is too much debt out there and at $45 a barrel there is still very little money to be made or spent in this business. Supply will continue to fall over the coming months and prices will keep going up. But longer term it will be choppy. The industry is in the midst of fighting a global market share battle. And it’s also fending off potential substitutes. It’s the mother of all market share battles,” he said before making his main point, “Expect many years of ups and downs; steep price recoveries followed by destabilizing price wars that weakens price.”

Dan, the physicist had been quietly jotting notes on his beer coaster. Nervously clicking his ball point pen he reminded the group of an inviolable law: “Isaac Newton said for every action there is an equal and opposite reaction. Prices have been pulled down, so like a spring they should quickly rebound to another extreme.” Putting down his pen, he explained with hand waving motions, “Like a complex wave form, there are three cycles in the oil business that are always out of phase: investment, production, and consumption. At any time, one of these is lagging the other two. In my opinion, the oil markets are inherently unstable.”

Deep thought produced a moment of silence.

Sheila broke the quiet, “You know that various agencies are saying that supply and demand are expected to even out by the end of the year.” Faking a television voice, she went on to parody a news-channel sound bite: “We think the oil market will be balanced by late 2016.” Her index and middle fingers wagged to act out quotation marks around the word “balanced.”

All three broke into laughter. Dan doubled over nearly spilling his drink.

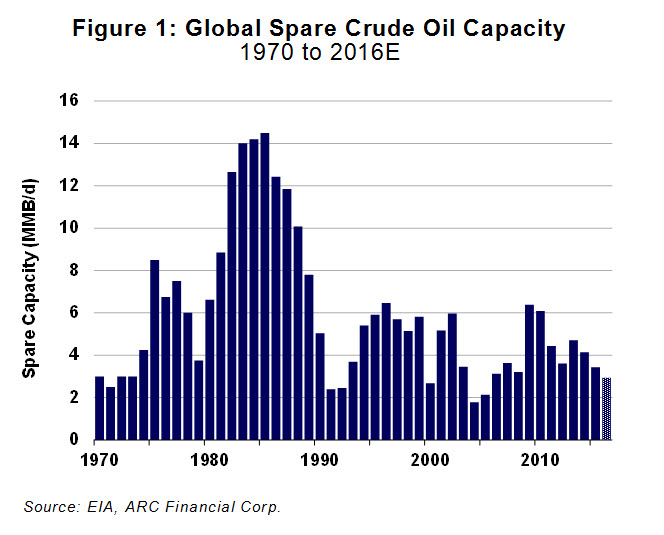

The notion of oil markets sustaining some sense of “balance” was hilarious to the three, noting that the world’s spare capacity was depleted – less than three million barrels a day – close to historically thin levels. On top of that, big producing countries like the US, China, Mexico and Colombia are starting to report serious output declines. Yet, falling output may not be smooth. Half a dozen major oil producing countries have the potential for sudden collapse, for example, Venezuela. In Nigeria, rebels are threatening to cut off all output. Meanwhile, deadpan agencies are reporting greater-than-expected consumption numbers (as if it’s any surprise when the price of a commodity falls by 70%).

“Seriously guys, when in the 150-year history of oil have markets ever been in balance?” asked Sheila pensively.

“Never!” exclaimed Aaron and Dan together, still laughing at the notion of stability when the world recklessly burns almost 100 million barrels of oil every day while the upstream supply chain succumbs to capital starvation, bankruptcy and civil unrest.

“Unstable systems oscillate, sometimes with great frequency,” concluded Dan in his physics lingo, “and the math says that rate of change stops only momentarily at the peaks and troughs.”

Hearing the laughter, an oil trader stumbled over from a nearby table and shouted, “A toast to future price volatility!” Pointing at the beer taps he yelled out, “Hey bartender, the drinks are on me!”