Commentary – $60 is in Style…For Now

Source: Pixabay.com

Source: Pixabay.com

I don’t know much about fashion, but I have heard that blue is the new black. And I know that by the time I buy blue, everyone else will be wearing green.

In the oil business, modish pundits are now pronouncing, “60 is the new 90,” championing the thesis that productivity gains, cost improvements and price wars have pulled the global clearing price of oil to $60/B, down from $90/B a couple of years ago.

The oilfields of the world share some similarity to fashion ateliers.

Designers in Paris and New York collude every fall to convince us all to wear new colours in the spring. Meanwhile, innovators in Houston and cartel leaders in Vienna claim that $60 a barrel is the new, long-term marginal cost of oil. As a result, a $90-per-barrel breakeven cost has become about as appealing to an oil investor as a wide necktie to a millennial.

Here’s the thing: Not everyone looks good in blue and not all producers have the rocks, expertise and infrastructure to make their financial statements look good at $60 a barrel.

Behind the scenes, the oil industry has become more discerning in its own way.

If there is one new style that’s obvious it’s that “short-cycle” investing is the new “long cycle.” In other words, smaller capital outlays, faster payback and more certain returns have become de rigour for oil and gas investing. No more multi-billion-dollar, decade-plus projects that are subject to the long-term vagaries of geopolitics, the threat of expropriation, corruption, civil war, policy uncertainty or outright obsolescence.

Like a traditional navy suit, investing in short-cycle projects is a fad that’s unlikely to end soon. Premier American oil fields like the Permian, Eagle Ford and Bakken are conducive to drilling when the trading screen flashes $60 in New York. So too are equivalent Canadian oil plays that are becoming trendy.

More of the world’s oil resources are in vogue too at $60/B, more than there was two years ago. “Half-cycle”, partially developed projects with easily accessible infrastructure can be in business at $60 or less. And cheap Middle Eastern oil never goes out of style – although the above-ground social costs are necessities that can make a barrel considerably more expensive.

But this is all just theory in a world that is largely running on excess oil inventories.

There isn’t any field-tested evidence to suggest that there are enough short-cycle, $60 projects to satisfy our world’s near 100-million-barrel-a-day appetite over the next several years. What is certain is that the geography of places where under $60 works is not as great as where $90 used to work.

From a free-market perspective, it’s long been noted that about 80% of the world’s oil resides under state-controlled oil regimes. Twenty percent exists in places like the United States, Canada and the North Sea. Of that 20%, a significant portion was of the long-cycle variety, for example big oil sands and frontier Arctic projects. So, the set of investible opportunities is geographically and financially much narrower than it used to be, at least for now. Admittedly, the 80/20 ratio could become less skewed as new processes open up greater quantities of “unconventional” oil in places like Argentina, Mexico, Russia and China. However, North America is almost a decade further up the learning curve after drilling and completing tens of thousands of wells. Other regions have long-term promise for sure, but it will take considerable time to replicate the US experience in a sub-$60/B price environment.

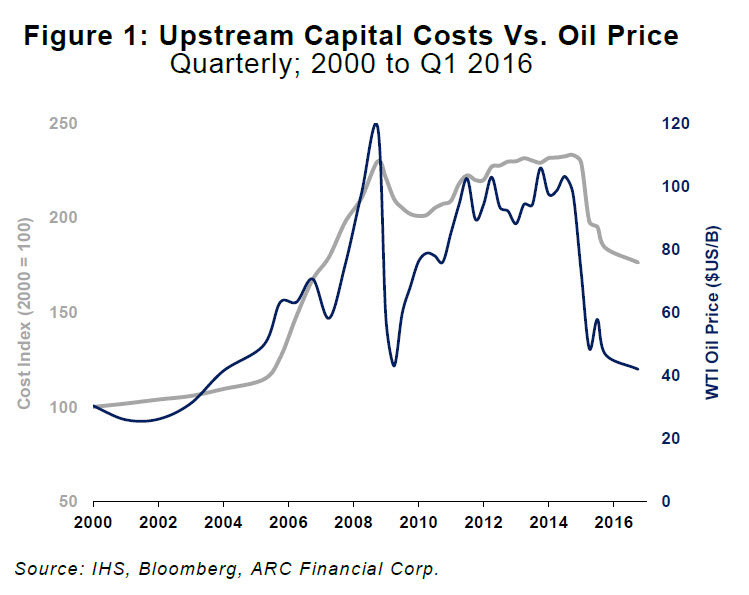

Once the oil storage glut clears, producing companies will need to ratchet up their upstream spending. Several hundred billion dollars must be invested over the next few years to bring oil out of the ground from a far more concentrated set of opportunities. And that looks problematic when looking at the historically high correlation between oil price – hence cash flow and investment – and costs (see Figure 1). Piling into North American tight oil plays, or even some new ones abroad like Argentina, has high potential to over-capitalize concentrated areas and drive costs much higher. Land prices in many potentially sub-$60 plays are already inflating quickly.

All of this is to say that $60 may be the new $90, but only until such time as everyone strips the rack of $60 opportunities, driving costs up again. Then just like cycles in the fashion business, the oil industry might be wearing $90 again.

But all of this fashion lingo is just talk right now. The price of oil hasn’t shown $60 yet. The industry is still wearing a skimpy 50 bucks a barrel.