The Fall of Oil and Gas Stocks

We first published this week’s SnapChart back in May.

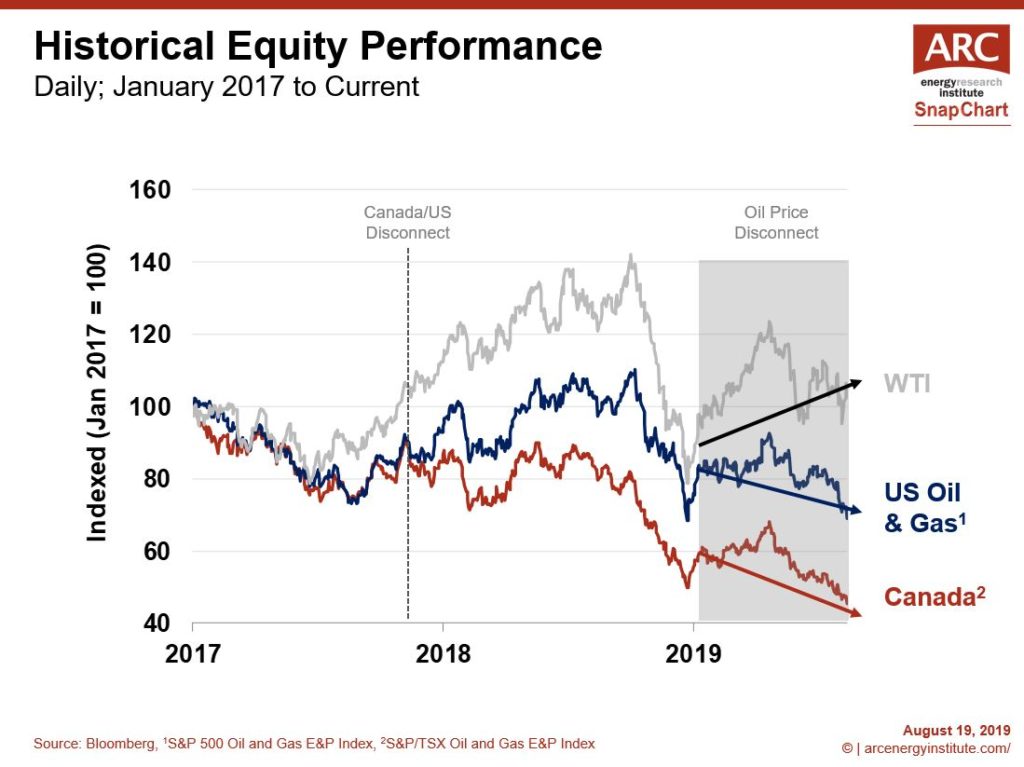

As before, we plot the astonishing fall of key public equity indices for upstream oil and gas producers in the United States and Canada. Since January 2017, Canadian producers are down 50 percent and US producers are down 30 percent.

There are two market disconnects that have contributed to the value loss. First, in late 2017, the Canadian equities began discounting relative to their American peers as a result of growing egress issues (see “Canada/US Disconnect” on the chart).

The second disconnect began in early 2019, when oil and gas equites on both sides of the border started to decouple from oil price. Oil price increased, yet the stock prices fell (see “Oil Price Disconnect” on the chart).

Since the beginning of 2019, WTI oil price has increased over 20 percent, but the Canadian index has fallen by about 16 percent. US oil and gas equities have suffered the same disconnect, though not as severe: down nearly 5 percent. Investor sentiment toward the North American oil and gas sector is not improving, with the sell-off continuing this summer.

Indices are mere averages. Many company stocks are down more than these broad markers. Sub-sectors are also affected differently. Looking at some intermediate and smaller Canadian company names, equity values are down a staggering 70% from 2017. Many stocks have reached stock prices not seen since the early 1990s, or never seen.

Because of the sell-off, the market capitalization of oil and gas companies has shrunk along with their relevance in the overall market. Back in 2014, energy companies made up nearly 30 percent of the value in the Toronto Stock Exchange; today the share has shrunk to 16 percent.

Market capitalization has been cut so much that several Canadian oil and gas producers have been removed from the common indexes that represent the Canadian stock market, such as the Canada S&P/TSX Index. More will likely follow.

While their share prices have been crushed, some oil and gas producers continue to pay a fixed dividend payment. The dynamic of lower equity values combined with shareholder distributions has driven up the dividend yields of some companies to double-digit levels, in the range of 10 percent and higher. Try beating that in some other type of investment in the current low (and getting lower) interest rate world. But even these big payments do not seem to be enough to bring investors back, at least for now.

The situation and implications will be the topic of a future ARC Energy Ideas podcast to be recorded in early September.