SNAPCHART – The Canadian Oil & Gas Currency Advantage

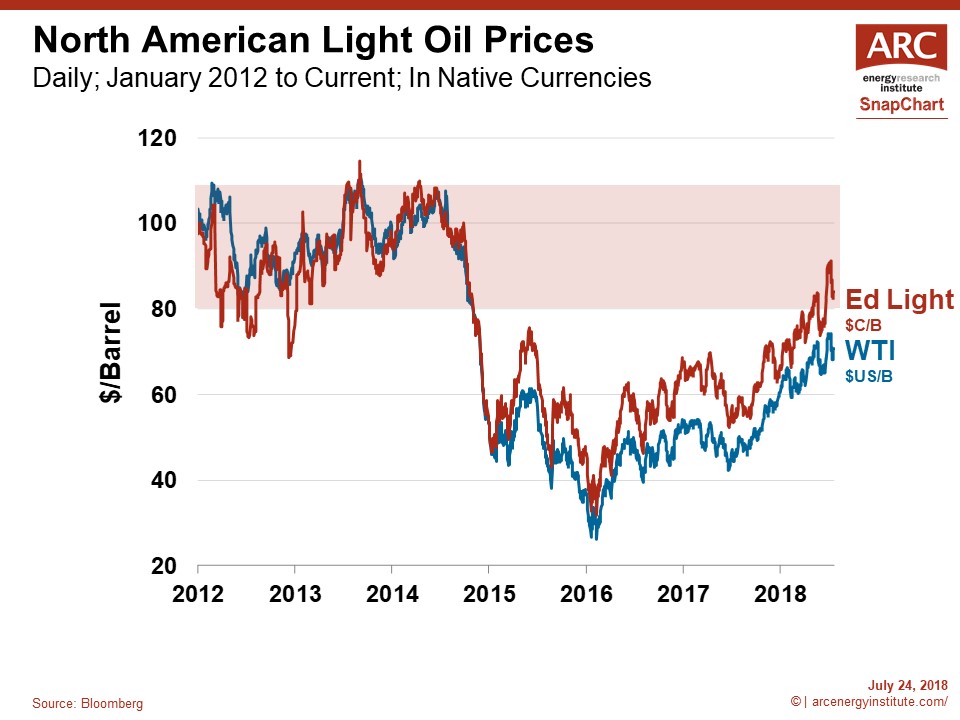

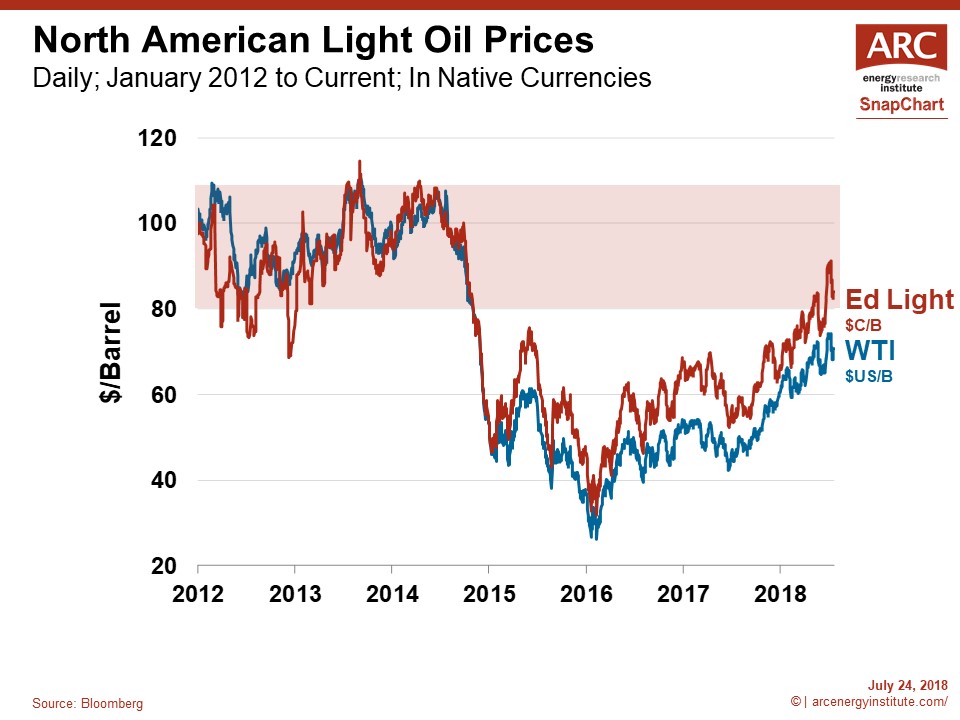

This week’s SnapChart compares the price history of West Texas Intermediate (WTI) and Canadian light oil (Edmonton Light), each evaluated in their respective domestic currencies.

The price for light Canadian oil is more robust these days, trading above $C 80/B and starting to enter a price range last visited before the 2014 market downturn. In domestic currency terms, the recovery in WTI price has lagged Edmonton Light. A stronger showing for Canadian oil is the result of a weaker Canadian dollar relative to four years ago. Measured against the greenback, the Loonie has fallen from 90 cents in 2014 to 76 cents now.

Weaker currency does have some advantages. It makes Canadian oil and gas producers more profitable than they would be otherwise. They can sell their commodities in high valued US dollars and pay much of their expenses in weaker Canadian currency. Think of it this way, today’s exchange rate equates to a 31 percent uplift in Canadian dollar denominated revenues for producers, boosting the amount of cash that flows to the bottom line.

Typically the Canadian exchange rate appreciates with WTI oil price, but that is not the case now. WTI has increased by almost 50 percent in the past year, but the Loonie has traveled the other direction sinking from 80 cents to 76 cents.

Canadian dollar weakness is caused by a barrage of issues. Slower economic growth in Canada compared to the US is one matter (in their July outlook, the IMF expects Canadian GDP to expand by 2.1 percent this year vs 2.9 percent in the US). Another issue is wide cross-border interest rate differentials (the Bank of Canada benchmark rate is currently 1.5 percent, compared with 2 percent in the US). The scale and severity of tariffs on Canada-US trade flows is a serious matter (while the tariffs announced so far are contained to a limited set of products, including steel, President Trump has threatened to put tariffs on the auto sector). Lingering concerns about the effects of a renegotiated NAFTA agreement on the Canadian economy is another headwind.

Considering the long list of big issues weighing down the Canadian dollar, is likely to remain stuck in a lower range for a while, providing a domestic cash advantage for Canadian oil and gas producers.