SnapChart – Cancellation of Canadian LNG Project

Yesterday, Petronas announced that it would not be proceeding with its Pacific NorthWest (PNW) LNG project. The project would have shipped 1.6 Bcf/d of chilled gas from British Columbia’s northwest coast to Asia by the early to mid-2020s. It is estimated that the project, including the investment in the upstream gas production and pipeline assets, was to cost $C 36 billion over its lifespan.

Yesterday, Petronas announced that it would not be proceeding with its Pacific NorthWest (PNW) LNG project. The project would have shipped 1.6 Bcf/d of chilled gas from British Columbia’s northwest coast to Asia by the early to mid-2020s. It is estimated that the project, including the investment in the upstream gas production and pipeline assets, was to cost $C 36 billion over its lifespan.

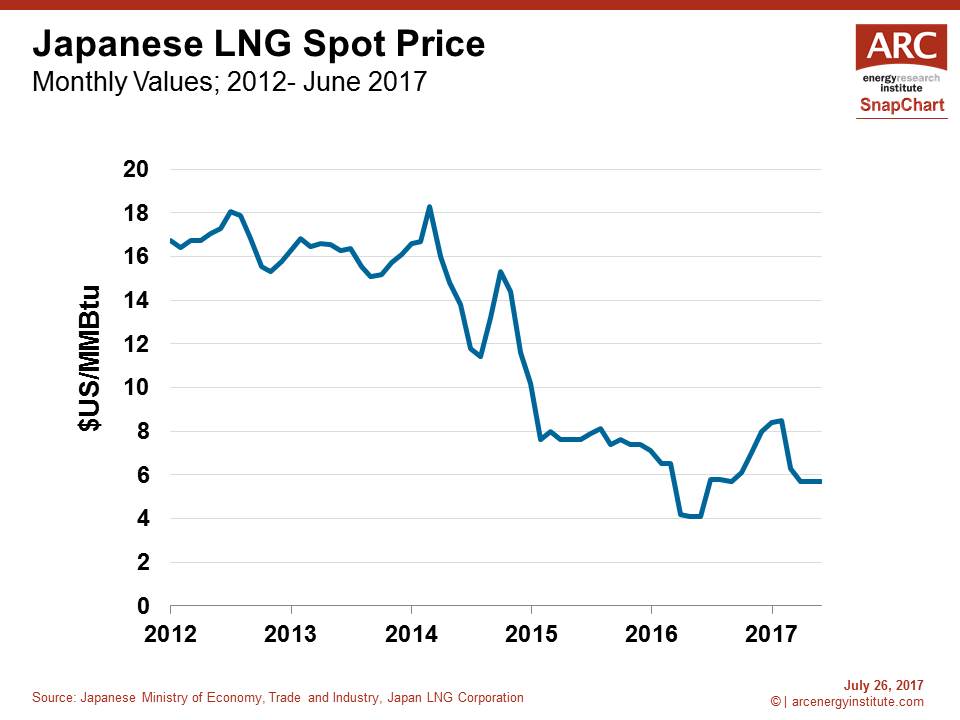

Petronas cited the challenging LNG market conditions as a key reason for their decision. A global oversupply of LNG has depressed price. Five years ago, when Petronas first announced its intention to proceed with its’ Canadian megaproject, the Japanese LNG spot price was nearly triple what it is today. As a result of the global LNG glut, depressed commodity pricing and a lack of cash in the industry, projects around the world are having difficulty proceeding.

While the PNW cancellation is very disappointing, there are still other potential opportunities for Canada to increase its natural gas production and exports. By the early 2020s, Canadian exports to the US should increase by over 1 Bcf/d as a result of greater flows on existing pipelines. Additionally, growing domestic consumption (from oil sands and conversions to natural gas for power generation) will create 1 Bcf/d of future demand. Finally, there are still other Canadian LNG projects potentially advancing, including LNG Canada’s 1.7 Bcf/d west coast project and the smaller 0.3 Bcf/d Woodfibre LNG project that is already sanctioned for construction.