Commentary – Supply is Still Growing But Pace is Slowing

The casualties of low oil price are stacking-up. Pink slips are being handed out at alarming rates, oil rigs are lying idle, and the list of cancelled mega projects is growing. But world oil supply growth has not yet been injured by the downturn. This may be about to change.

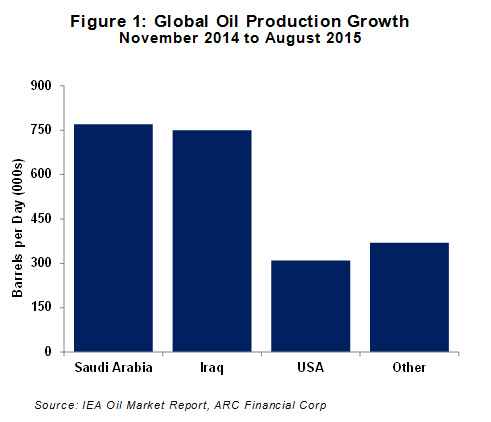

Figure 1 highlights the three countries that have meaningfully increased their oil production since last November, when Saudi Arabia changed its strategy from defending oil price to focusing on market share.

Since November 2014, Iraq’s oil production has surged by almost 0.8 MMB/d. But it is uncertain how much higher production can go from here. In the north, military attacks on infrastructure and souring relations between Kurdistan’s regional government and Baghdad, are dragging on production growth. Supply gains in the south have mostly been the result of new infrastructure, but the prospects for large production gains are dwindling along with investment levels.

Saudi Arabia has increased production by 0.8 MMB/d compared with last November. August’s production came in at 10.3 MMB/d, a near record level. Even at this elevated rate, the IEA predicts that the country’s spare capacity is still 2 MMB/d. However it is uncertain how much higher production levels will go from here, especially considering Riyadh’s historical philosophy of maintaining some extra capacity to cushion the world’s oil markets and to help Saudi Aramco optimize their operations.

Despite a sixty percent drop in US oil drilling rates compared to last year, American oil production still gained 0.3 MMB/d between November 2014 and August 2015. However, the production response from less drilling is now just starting to show-up. By year end, compared with the peak level achieved this past April, the IEA and EIA expect US oil production to drop between 0.5 and 0.7 MMB/d.

The “Other” category in Figure 1 sums together all the countries that have registered small oil production gains, minus the producers who have registered losses. Countries that made modest production increases include Russia, Kuwait, UAE, Angola and Indonesia. As a result of oil sands facility outages this past summer, Canada was one of the countries that registered a temporary production loss compared with November. Libya also lost supply. The country’s civil war has shut in its production, blocked pipelines, and closed oil terminals. Both Nigeria and Venezuela saw slight declines over the period, and the outlook for these two countries leans towards more production declines, not increases.

Iran’s production is up slightly over the period, but the country is itching to make larger increases to its output. July’s nuclear deal put Iran on a path that could technically boost the country’s production levels by early 2016. The Iranian Oil Minister expects that within a few months of lifting the sanctions, crude oil production could grow by 1 MMB/d. Other agencies have a more conservative outlook, for example the IEA expects Iranian production could grow between 0.5 and 0.7 MMB/d when sanctions are removed.

Beyond Iran’s immediate production gains, it is uncertain how much more production can grow. While Tehran is already starting to make plans for opening-up its long neglected oil fields to foreign capital and technology, the fruits of these efforts are not likely to be immediate. For example, when Iraq struck deals with international investors in 2009, it took another two or three years to register any meaningful production gains. The Iran situation also has some unique investment risks, since the nuclear pact allows for sanctions to be slapped on quickly if Iran does not follow through on its obligations under the deal.

Adding up all the country-level changes in oil production, global oil supply has increased 2.2 MMB/d since last November. This is a big number. To put it in perspective, the oil supply growth since last November alone is responsible for about 85% of the world’s current glut. And, more supply could be coming if Iran can unshackle itself from sanctions and increase its production level next year, or if Libya could turn things around.

But there is some room for hope in this seemingly gloomy situation. At this point, the list of countries that can add more production is getting smaller. It is uncertain if Iraq or Saudi Arabia can, or will produce more. For many other producers (including the US), the expectation is that future production levels will decline, not increase. So, although the crude oil glut looks like it will extend into next year, it is losing some momentum. A deceleration in supply, combined with robust demand, will eventually conspire to strengthen prices.