Look, No Gas Storage

And now ladies and gentlemen, for the final trick of natural gas… look, no storage!

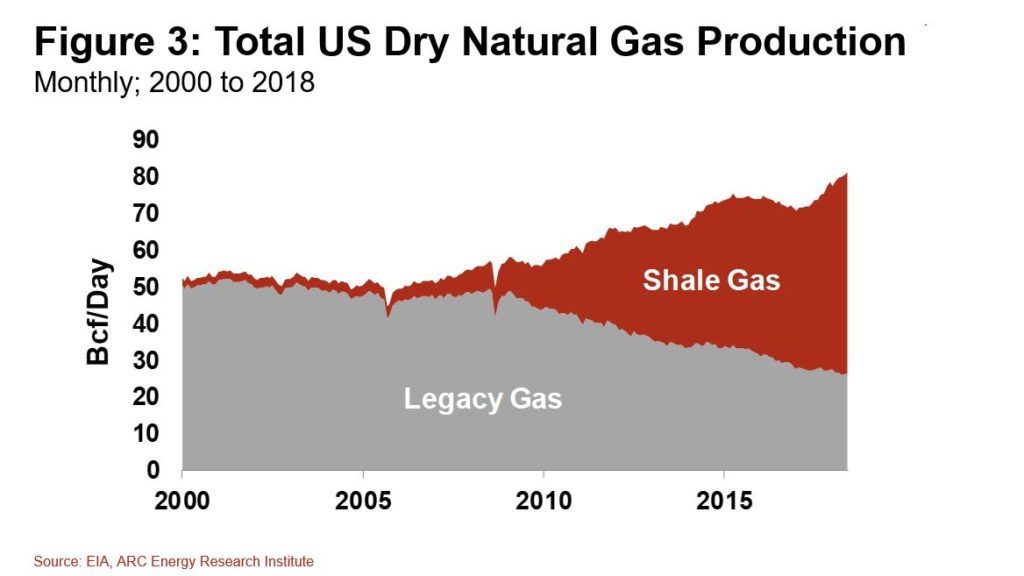

The transition of North American natural gas from a high-cost, volatile-priced commodity to one that’s cheap and relatively stable has been remarkable. And it’s all happened in less than a decade (see Figure 1).

But the gaseous fuel has performed a final act, convincingly unveiling its latest feat this year: the diminishing need to store the product.

Only a few years ago it felt like every molecule of natural gas needed to be hoarded. Prices would strengthen every time volumes held in storage caverns would fall below the closely watched 5-year average. Then, a simultaneous cold-snap on the east coast would call keyboard-happy gas traders into action, driving up prices further.

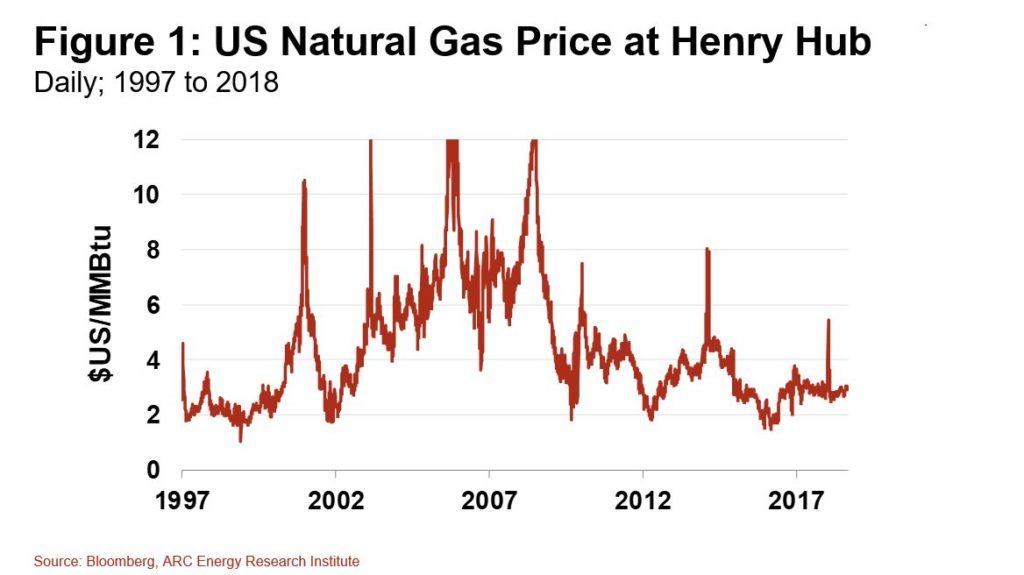

Now, the weekly storage report elicits a big yawn. Recently, the collective volume of natural gas in caverns and holding vessels dropped to a 15-year low, “off the charts” as is proverbially said (see Figure 2). Despite record demand nothing happened. In fact, last week, the price of gas remained steady even with a hurricane blowing through the gas-rich Gulf of Mexico (another event that would have historically caused a price spike). In fact, traders are now more concerned about a storm’s ability to crush demand, not supply.

Gas pundits no longer need to take night courses in meteorology. Seasonality has become a much less significant price determinant. Predicting degree-days and changes in storage volumes has gone from a competitive game among analysts to the back tab of their spreadsheets.

Storage for natural gas has been a historical necessity, because of the intense seasonal demand for the fuel when air conditioners spin during the summer or when furnaces fire up in the winter; especially the latter. Historically, producers couldn’t drill gas wells fast enough to supply changes in seasonal demand. So, like squirrels stocking nuts, the gas industry built up their winter stash in summer.

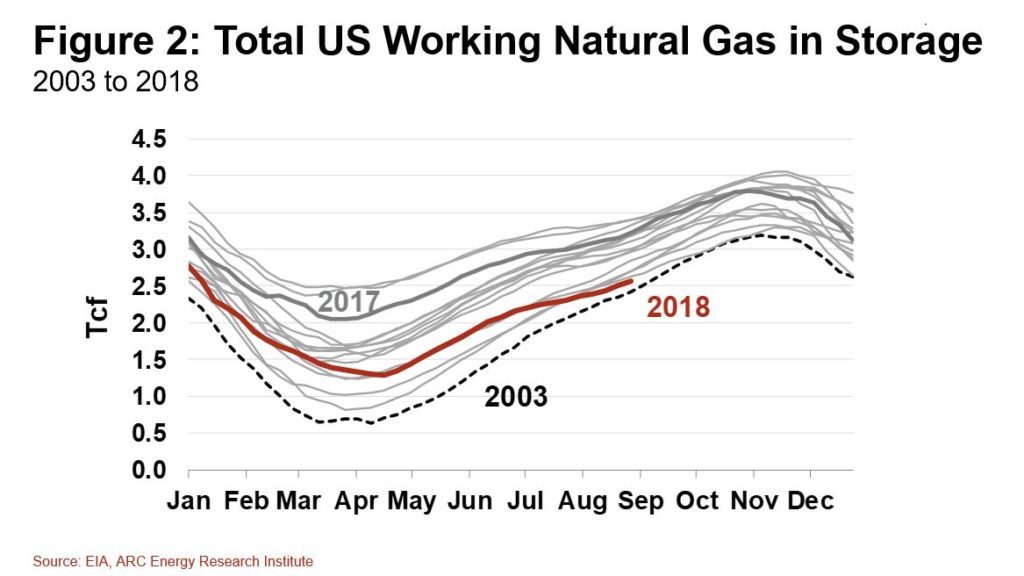

But that’s all changed. Many charts tell the North American story of how natural gas has evolved to be cheap, abundant and quick to deliver. Take for example, US gas production, once assumed to be on a quickening ‘treadmill’ of decline. Output in the last 12 months has made a 9 Bcf/d step jump, handily crossing the 80 Bcf/day mark and achieving the largest one year production growth in history.

As I’ve written recently (See: Deflating the Energy Scarcity Mindset), low-cost natural gas prices are an artifact of the new age of energy abundance. Collective process innovations that include horizontal drilling, faster drilling, pad development and multi-stage hydraulic fracturing are the biggest disruptions to hydrocarbon extraction—and the energy industry writ large—in over a century.

Falling a little short of gas? Just drill a few more wells. The ability to bring gigajoules of gas out of the earth’s crust has increased by an order of magnitude. New technology can access trillions of cubic feet of potential with rigs that are two times more productive than five years ago. Of course, some level of storage will always be needed, the question is how much? We don’t know yet, but the notion of natural gas inventory is migrating from storage facilities right back into the source rock.

In fact, extracting natural gas is now a manufacturing process that is following the just-in-time delivery model championed by many other industries. Less inventory means less cost, making the whole system more competitive in the energy complex.

In Western Canada, natural gas production is near record output levels too. It would go higher but like in many parts of North America it has nowhere to go, being market constrained. So, the stuff is backing up at the reservoir and in some cases coming out of the ground for free.

But here is the curious thing: while natural gas systems are shedding the need to store energy, renewable systems are moving toward strapping on storage (like batteries) to challenge natural gas power generation. It will remain competitive between the two systems, but the main loser from relentless innovation in gas and renewables will be coal.

The biggest and fastest energy transition in North America hasn’t been the addition of renewables, nor the pushing out of coal. It’s been the substitution of conventional natural gas with shale gas. In less time than the iPhone has been out, the latter has taken almost 70 percent market share, pushing legacy gas fields into terminal decline (see Figure 3).

Low-cost, abundant, and now quick to deliver; the North American shale revolution has transitioned natural gas into a new system of energy supply that’s increasingly tough to beat.