Commentary – The Long and Short of Oil Price

Source: www.Dreamstime.com © Aremac

US benchmark West Texas Intermediate (WTI) crude oil hit a new low on Monday morning, trading under $US 35/B. Meanwhile, Brent crude oil was trading just above $US 36/B in international markets. More than a year into this downturn, these new floorboards for the price of oil are discouraging milestones.

The catalyst for the latest price drop stems from OPEC’s December 4th decision not to cut its oil production. Even though OPEC was widely expected to stay the course (see November 17, 2015, ARC Energy Charts commentary titled “It’s a Price War…Still”), the news of no cut still sent oil prices sliding.

But if OPEC’s move last week was expected, why did oil prices decline?

Part of the answer lies with the money managers in the oil markets—the participants who aim to profit by gambling on the future price of oil. Examples include hedge funds, traders, and retail investors in oil-linked Exchange Traded Funds (ETFs). Through this past year, such market participants have helped to keep the price of WTI above $US 40/B.

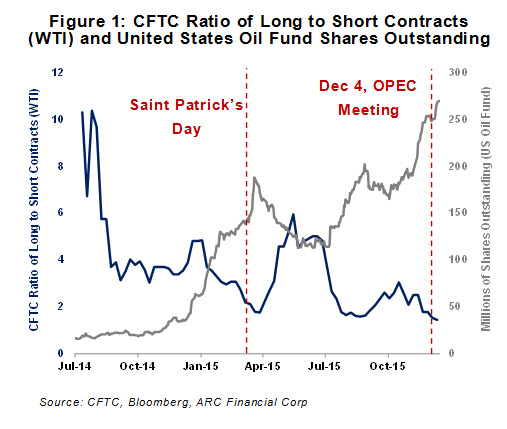

The main window to the activities of the money managers can be found in the weekly data published by the US Commodity Futures Trading Commission (CFTC). Each week the government organization publishes the number of long and short contracts held by money managers and traders. The long contracts are betting the price will move up, and the short contracts are counting on lower prices.

An example of how market participants help to establish a floor for WTI oil price can be seen in the trading activity around Saint Patrick’s Day. The famous Saint’s birthday marked the first low point in the 2015 oil price rout, when WTI settled at $US 43.50/B. In the CFTC’s first weekly report following the low point, money managers had increased their bets that WTI oil price would fall. However, by the following week, more contracts were leaning toward prices increasing, and the relative number of bets for higher oil price continued to gain in the subsequent weeks (see Figure 1). The low oil prices were seen as a buying opportunity.

Last week however, commodity players were betting against a recovery in oil price. On Friday, the CFTC data showed the money manager trading statistics for the week ending December 9, 2015, when WTI was trading at $37/B. Despite the oil price reaching a new low for the downturn, there were increasing bets that WTI oil price would fall. This bearish dynamic is exactly what occurred following the Saint Patrick’s Day low point. So it is still possible that the momentum could turn in favor of price increases in the next weekly report, especially when you consider the sheer number of short contracts in play. In total, the number of short contracts is currently more than two times higher than at the end of the second quarter. At some point, traders will need to exit these positions.

Another window into the activity of speculators can be seen by analyzing oil-linked ETF trading activity. Even though retail ETF investors are a relatively small subset of all of the market, they are worth examining since their daily trading activity can be easily analyzed. The outstanding shares of the United States Oil Fund (an ETF that tracks the price of WTI) is shown in Figure 1. Between July 2014 and February 2015 the number of shares of US Oil Fund increased seven times. Like the broader market, retail investors aimed to profit as the oil price recovered.

An example of how ETF investors help to establish a floor for oil price is seen in the trading activity around the Saint Patrick’s Day low point, when the number of shares in the US Oil Fund increased by ten percent from the previous day. Within three days, the ETF’s outstanding shares were up over 20 percent.

Based on the US Oil Fund trading leading up to and since the December 4th OPEC meeting, there is no reason to think that investors in the US Oil Fund have lost any enthusiasm for the oil markets. By close of day yesterday (December 14), US Oil Fund shares had reached a new high for the year.

Looking ahead, speculators could still increase their bets on a price recovery in the coming weeks and help to prop up oil prices, especially when you consider the need to exit a large number of short positions. As well, the ETF buyers (as measured by US Oil Fund) are still actively increasing their bets.

All this helps explain near term volatility and why oil prices lost ground last week in the absence of hard fundamental data. Poor visibility on tangible fundamentals is likely to be the norm over the next few months, so expect market speculation to amplify even the slightest change in expectations.