THE NATURAL GAS DEBATE

“Natural gas is a bridge to a lower carbon future; demand will grow for decades to come” asserted the debater. Her opponent snapped back “natural gas is a bridge to nowhere. Low cost wind and solar power backed-up with batteries will replace natural gas sooner than anyone expects”.

While there is debate about the future of our energy systems, today’s reality continues to suggest strong growth for natural gas. Last year the world consumed 3 percent more methane molecules than the previous year, almost twice the historical rate of growth for gas. As a result, natural gas was the number one fuel for meeting the growth in primary energy demand in 2017, beating out renewables by 26 percent[1] .

The upward trend for gas was underpinned by a 15 percent surge in Chinese consumption. Demand in China is still growing. The country’s five-year plan is delivering on cleaning up air pollution by switching industrial boilers and residential heating systems from coal to natural gas. Existing coal fired power plants are being shuttered and new construction halted. As a result of these ongoing structural changes, China is expected to soon overtake Japan as the world’s largest importer of natural gas[2] .

China is not alone in its pro-gas policies. Energy-thirsty India, which will soon have more people than China, has pledged to double its share of natural gas in the energy mix by 2020. To support the expansion, India will triple their LNG import terminals over the next seven years[3] .

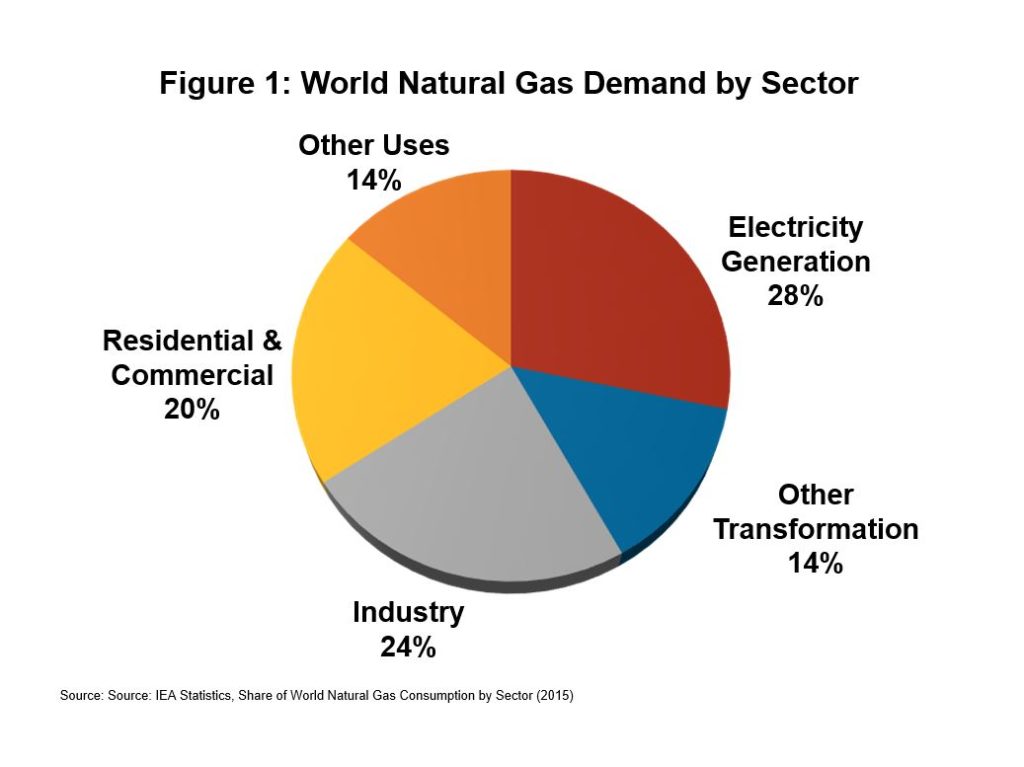

Despite the current strong trend for gas, falling costs for renewable generation and battery projects are fueling an “end of gas” discussion. In thinking about the likelihood of “peak gas” due to competition with wind and solar, we shouldn’t forget natural gas is not exclusively used for power generation. Figure 1 dissects the International Energy Agency (IEA) estimate of global uses for gas, by sector. Worldwide, less than one-third of gas consumption comes from power generation.

Historically, electricity generation has accounted for half of all gas growth, but this is already changing. For example, electricity was only 15 percent of the 2017 increase. Competition from renewables and cheap coal in emerging markets are causing a slowdown for new natural gas generation projects.

Historically, electricity generation has accounted for half of all gas growth, but this is already changing. For example, electricity was only 15 percent of the 2017 increase. Competition from renewables and cheap coal in emerging markets are causing a slowdown for new natural gas generation projects.

Assuming that renewables take over for new natural gas fired power plants at some point in the future, this would not displace the demand from the existing generators that are built for 20 to 40 year lives. These already constructed plants would continue to make electrons, even at low power prices since they would only need to recover their operating costs.

The industrial segment uses 24 percent of all natural gas. Heavy industries consume methane for various uses including making petrochemicals and fertilizers. Over the past decade industrial growth has increased about two percent annually. The IEA expects this segment will be the fastest growing segment of natural gas demand in the future, averaging near 3 percent annually or about three times greater than for power generation[4] .

Residential and commercial uses for gas include home heating, cooking, water heating, lighting and drying. Consuming about 20 percent of all demand, historically home and commercial uses have grown at over 1 percent annually. The go-forward outlook is similar. The other demands for natural gas, including transportation and upstream production, have been steadily growing at the same rate too.

Other transformation makes up 14 percent of gas demand. This grouping includes natural gas used in combined heat and power plants. These facilities make electricity with the waste heat from another process.

Back at the debate, the pro gas panelist rattled off her closing arguments “While natural gas power generation is coming under threat from renewables, peak gas demand is not in sight”. She continued “electricity makes-up less than one-third of all gas consumption, and the other uses for gas are still growing as the result of pro-gas policies in populous countries like China and India. From my seat natural gas is poised to be a bridge to the future for decades to come”.

[1] IEA Global Energy & CO2 Status Report, March 2018 http://www.iea.org/geco/

[2] IEA Market Report Series: Gas 2018 Analysis and Forecasts to 2022, June 2018 https://www.iea.org/gas2018/

[3] Reuters “India plans massive natural gas expansion, LNG imports to soar”, February 2018 https://www.reuters.com/article/indonesia-lng-summit-india/india-plans-massive-natural-gas-expansion-lng-imports-to-soar-idUSL4N1PW5M0?platform=hootsuite

[4] IEA Market Report Series: Gas 2017 Analysis and Forecasts to 2022, July 2017 https://webstore.iea.org/market-report-series-gas-2017