Commentary – The Nature of the Oil Beast

Source: www.Dreamstime.com © Beehler

Nature shows can be troubling. We’ve all seen the imagery. Hobbling wildebeest on the African savannah dying off during a drought. Meanwhile, dispassionate lead animals barely glance back at the weak. Resolute and disciplined, the strong march on to their watery destination, becoming stronger through their pain.

The corporate savannah known as the “oil patch” was displaying its own version of Darwinism last week. Weak companies, emaciated by a drought of capital were beginning to succumb to market death. Blue-suited bankers were making their moves, stalking companies lean on cash and fat on debt. Meanwhile, mighty ExxonMobil, the fit leader of the migrating herd, announced that things would be tough for a while yet, but that it will adapt, survive and even thrive under today’s parched oil prices.

Yes, there are dark clouds looming ahead in the land called the oil patch. But these clouds are not bearing rain – just more trouble.

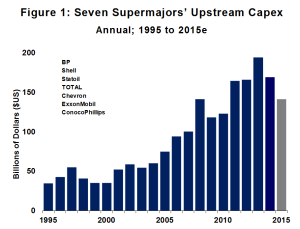

Few are as strong as ExxonMobil, which despite its resilience only supplies the world with 2.3% of its 93 million barrel-a-day addiction. And even it is going to husband its capital during this downturn; Chairman and CEO Rex Tillerson announced a $34 billion capital budget for 2015, down 12% from last year. It doesn’t sound like much among the big and mighty, but it’s the collective capital cuts by the whole multinational pack that’s notable (see Figure 1).

Relative to 2014, multinational upstream capital expenditures will be down by $28 billion this year. But it’s the comparison to the 2013 peak that makes the cuts by this group-of-seven look stingy. Relative to two years ago, their 2015 spending will be down by $53 billion, or 27%. These are just dull numbers today, but those with elephant memories will think back to this penny-pinching behaviour in a few years, when world oil supply struggles to keep pace with consumption.

Relative to 2014, multinational upstream capital expenditures will be down by $28 billion this year. But it’s the comparison to the 2013 peak that makes the cuts by this group-of-seven look stingy. Relative to two years ago, their 2015 spending will be down by $53 billion, or 27%. These are just dull numbers today, but those with elephant memories will think back to this penny-pinching behaviour in a few years, when world oil supply struggles to keep pace with consumption.

In our world of instant gratification, the multi-year lag between spending money and pumping oil is not fully appreciated. Much of the world’s oil production additions over the next few years will accrue from the ramp up in spending that took place during the period of plentiful capital, between 2011 and 2013.

From their March 4th news release, ExxonMobil’s 2015 on-stream project list reads like a National Geographic Atlas: “Hadrian South in the Gulf of Mexico, expansion of the Kearl Project in Canada, Banyu Urip in Indonesia and deepwater expansion projects at Erha in Nigeria and Kizomba in Angola.” In 2016 and 2017, new oil and gas production will come from Australia, Eastern Canada, the United Arab Emirates and far east Russia. All of this global iron is impressive, but ExxonMobil’s megaprojects are exactly the type that other oil companies have been axing over the past 18 months. In fact, Statoil delayed another two of its offshore projects – Johan Castberg and Snorre – in the North Sea last week.

Being big on the savannah doesn’t correlate to being strong. Oil production from the seven largest multinationals peaked in 2006 at 12.5 MMB/d. Today, almost 10 years hence, their oil output is down by a fifth to 10.1 MMB/d. That’s hardly called growth – especially after spending $1.3 trillion over the same period. Natural gas has been more of a source of growth for the group, but even that’s been faltering lately.

So, what does all this say about other, sore-hoofed international oil producers that are trying to march on in a sandstorm of sanctions, corruption, civil war, insurgency, anarchy and now capital starvation? A top Russian oil executive expects Russian oil production to fall 800,000 b/d by the end of 2016. Libya is self-destructing. Many parts of Iraq are in chaos. Venezuela is teetering on default. Nigeria has cancerous militants encroaching from the north. The list of the weak goes on. But due to low oil price, these five countries that pump out over 20% of the world’s oil production will generate approximately $300 billion less in revenue this year. In short, the world of oil outside North America is a big mess that’s in the early stages of chronic instability. No wonder multinationals are paring back their spending and rationing their capital toward the only place that has shown any stability and growth in the past five years: the United States and Canada, where the unique species of entrepreneurial independents graze on tight oil.

ExxonMobil’s chief said last week that markets should “settle in” for a period of oil prices around this level – in other words $50 a barrel. But to “settle in” at these levels is unsettling. In the wild kingdom of the oil patch, today’s capital drought looks like it’s leading to tomorrow’s supply drought.