This Time it’s Different

“This time it’s different.” That’s what oil analysts like to say during every boom-and-bust cycle.

But how different is today from previous yo-yo fundamentals?

Right now, we’re in an oil upcycle; prices have risen by 15% this year and wanting to go higher. On a volume basis, the growing addiction to oil is as great as it was a dozen years ago, creeping higher and higher at a rate of well over a million barrels-a-day, per year.

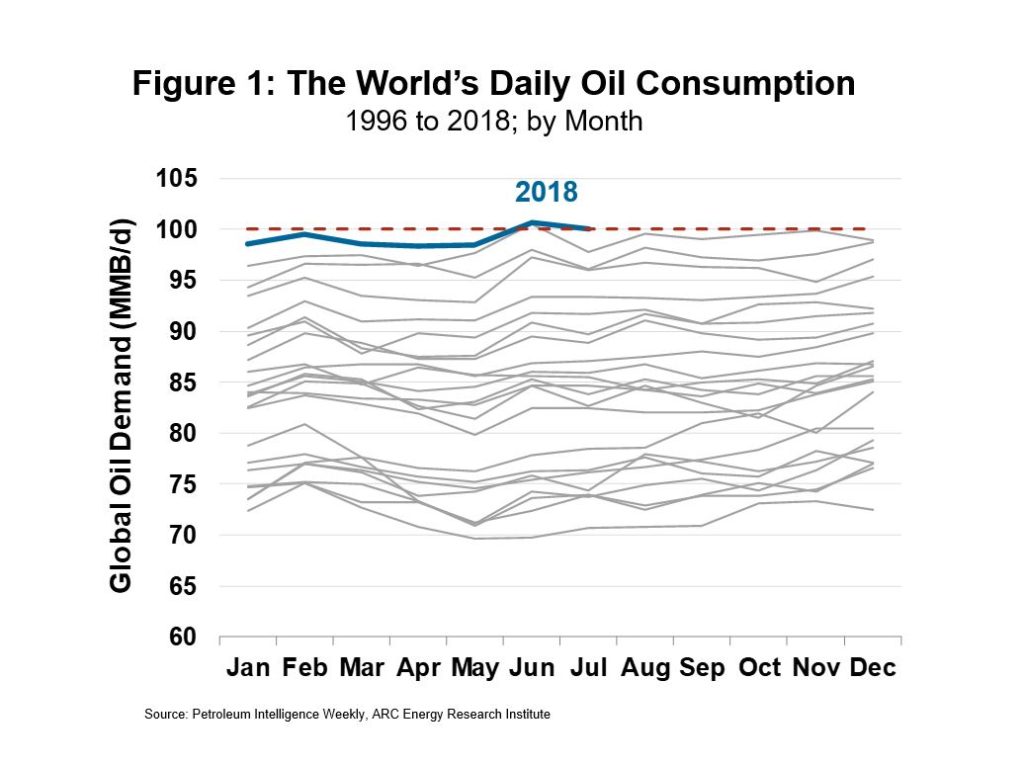

This year is a milestone. Consumption has (or will later this year, depending on your source) pushed through 100 million barrels-per-day, a barrier that was expected, but still mentally unfathomable in scale.

There are many déjà vu themes between today and the last bull run in the early 2000s. China, India and the developing world remain the big growth drivers. On top of that, the rest of the world’s economy is firing on all cylinders again, pulling harder on the world’s oil fields.

There are more commonalities with past up-cycles. Oil inventories and spare productive capacity are relatively thin. Upstream investment is lagging downstream consumption growth. And like a tired re-run, the geopolitical movie is playing again: Middle Eastern tension and failed oil states (like Venezuela and Libya) continue to antagonize markets.

Ten to 15 years ago, substitutes for oil were far from viable. Today, electric vehicles are emerging; yet despite a growing adoption trend, wheels being turned by batteries won’t be displacing meaningful oil barrels any time soon. So, the lack of substitutes is another recurring theme.

Let’s think about these commonalities. All of them—consumption, capital availability, geopolitics and potential substitutes—are ‘above-ground’ factors that influence the price of oil from above the rocks below.

During the last up-cycle the what-is-different theme was oilfield maturity—the whole “peak oil” thing. The ‘below-ground’ supply-side was hemmed in technologically at then-prevailing prices around $20 per barrel. Scarcity, induced by lack of oilfield innovation and maturity of the world’s oil reservoirs, was driving up costs from the rocks below.

In fact, the maturing of below-ground reservoirs has long been a bedrock of support for above-ground cyclicality.

Here’s what’s really different this time. The price of a barrel is going up due to usual above-ground factors, while technology is reducing the cost of finding, developing and extracting oil from below ground. This widening innovation dividend between below-ground cost and above-ground price is especially true among leading North American producers.

Above ground, oil consumers have crossed the psychological 100-million-barrel-a-day marker. At a notional $60/B, that’s a $2.2 trillion per year business. So, going forward, the trillion-dollar questions are: How will consumption be supported from below ground, and at what price? Because it really is different this time.