Commentary – Old Pistons Die Hard

This is the third in a series of columns exploring the potential impact of electric vehicles on oil consumption.

Internal combustion engines keep accumulating at a rate of tens of millions per year. When is the earliest date that we could expect to see “peak piston”?

Your intuition may be taxed when I say this, but more electric vehicle sales does not quickly equate to declining piston-fired cars on the world’s roadways.

Banning All Engines

In my last column, I pitched an aggressive de-carbonization scenario for transportation—a simultaneous, global ban on the sale of all new internal combustion engine (ICE) vehicles by 2040. In other words, I imagined that every country in the world, from Brazil, to Nigeria, to Russia, to China, rapidly accelerates their electric vehicle (EV) sales starting in the early 2020s. And within 25 years each and every country would commit to stop selling spark plug machines.

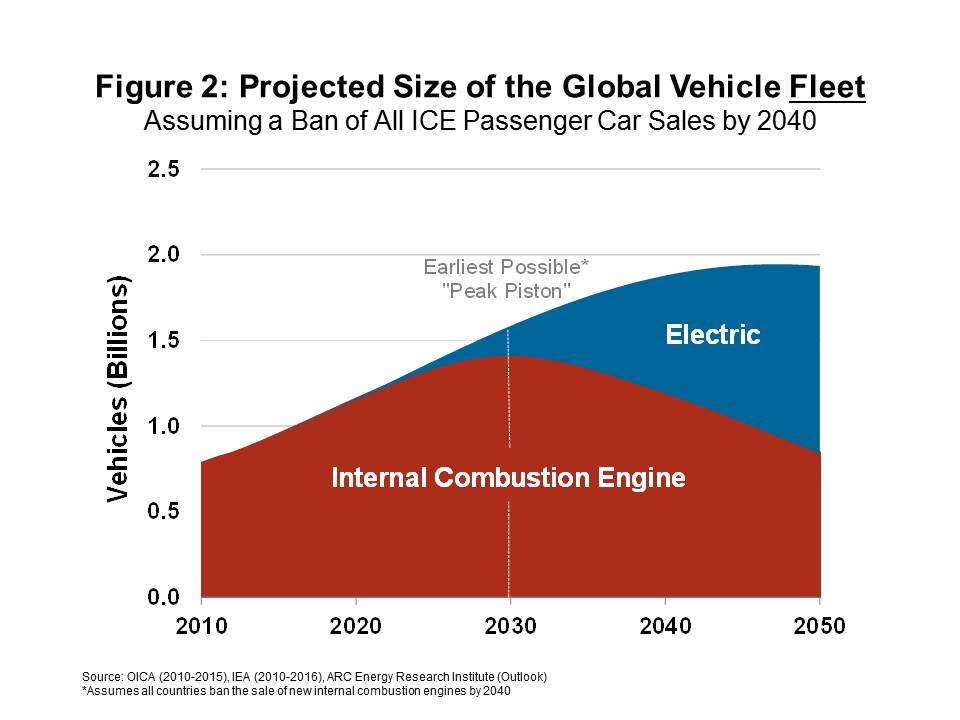

Even under such heavy-handed government restriction, the global fleet of purely petroleum-powered cars wouldn’t start to decline until 2030 at the earliest. By 2050, it’s quite likely that there would still be the same number of ICE vehicles on the road as today.

This counterintuitive dynamic arises, because the longevity of petroleum-powered transportation is more a function of how many ICE engines accumulate and stay in the global fleet over the next ten-to-twenty years, and less to do with how many new EVs of various sort—plug-in hybrids (PHEVs) or pure battery (BEV) types—are brought in.

The Issue of ICE Accumulation

In 2016, over 69 million new passenger vehicles of all types rolled off of global automakers’ assembly lines. On average, that number has been growing by a robust 5.0% every year since 2010.

Wealth creation, especially in developing economies, has been the primary determinant of how many new passenger vehicles are sold in a year.

The advancement of self-driving cars and ridesharing services are making mobility pundits rethink personal vehicle ownership. Belief in robo-chauffeurs and cars-on-demand suggests that total, year-over-year passenger vehicle sales may start declining by 2030. But by that time another 950 million ICE vehicles will have been sold to consumers, even after assuming aggressive EV sales!

So, ICE vehicles will continue to accumulate into the fleet in the tens-of-millions per year for at least a couple of decades. And the accumulation is amplified by the reluctance of them to leave the fleet.

ICE that Doesn’t Melt

“Scrappage” is the rate at which cranes with big magnets and cutters send old cars to the salvage yard.

In 2014 approximately 27.7 million vehicles were scrapped, or 3% of the 907 million moving around on the roads of the world.

Higher scrappage rates imply fewer ICE cars on the road over time, but the trend is actually pointing the other way. The ICE isn’t melting as fast as it used to. Recently, a popular auto site pitched a story on, “40 Cars that Will Last More than 250,000 Miles.” Conventional cars, pickup trucks and SUVs are becoming more reliable over time – leading to longer life cycles and more resilience to scrappage.

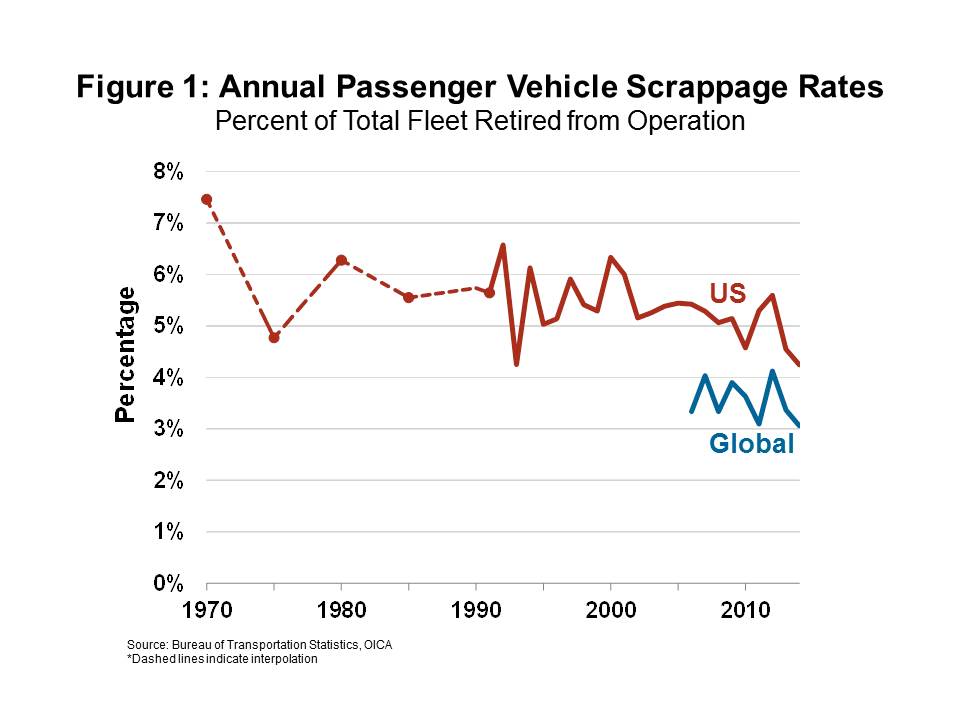

In mature economies like the US, the scrappage rate was just over 4.0% of the fleet, but it’s been declining over time (see Figure 1). Today, it’s half of what it was in the 1970s and falling. Globally, the trend line is the same, but the rate is lower, at 3.0%. Car-owners in less wealthy countries can’t afford to swap their cars out, so they tend to keep their wheels for longer. Yes, EVs are coming in, but new ICE cars are still accumulating by tens of millions per year, and are being driven for longer.

Yes, EVs are coming in, but new ICE cars are still accumulating by tens of millions per year, and are being driven for longer.

Academic research shows that a car-owner is less inclined to scrap their vehicle if the cost to repair it is less than its salvage value.

Which brings about a couple of important questions. Will a rapid introduction of EVs increase or decrease used ICE values? And the corollary: How will banning ICE vehicles affect consumer behaviour? The answer is that we don’t yet know how attached people are to their pistons.

In fact, banning ICE vehicles may yield a scarcity backlash. People may want used ICE vehicles, raising their values. Scrappage rates would fall, keeping a larger-than-expected number of them around for longer.

On the flip side, countries could impose massive carbon taxes and registration fees on remaining ICE vehicles, to scrap them faster. Select countries may.

Yet assuming every country disallows the sale of ICE engines by 2040 is already a stretched assumption; thinking that political leaders will have the backbone to tax your average SUV owner is a whole other level of belief.

Peak Piston

How do all these moving parts come together? Even under an aggressive EV adoption scenario, our second figure shows that peak piston isn’t likely to occur before 2030. That’s because of the residual sales momentum and retention of petroleum power vehicles. By 2050, 60% of the global fleet of personal vehicles could be composed of EVs, but the number of ICE vehicles remaining on the roads would not likely to be much less than today.

Even under an aggressive EV adoption scenario, our second figure shows that peak piston isn’t likely to occur before 2030. That’s because of the residual sales momentum and retention of petroleum power vehicles. By 2050, 60% of the global fleet of personal vehicles could be composed of EVs, but the number of ICE vehicles remaining on the roads would not likely to be much less than today.

Next time: Translating peak piston into peak oil demand.