Coronavirus: Implications for Oil and Gas

As the Coronavirus spreads, so does a potential contagion for lower oil prices. The virus is likely to infect global natural gas markets too, especially since LNG prices were already compromised before the outbreak.

Oil Price

The price of WTI oil is currently sitting near $US 50/B, down more than $US 10 from one month ago. Factoring in the wider Canadian price differentials, domestic pricing is now near $US 30/B for heavy oil and $US 41/B for light. For comparison, these prices are not as catastrophically low as experienced at the end of 2018, when Canadian oil averaged just $US 18/B for heavy and $US 25/B for light in November.

While the current situation is not quite as alarming as late ‘18, the weaker oil prices are once again compressing the cash flow of Canadian producers. If these depressed prices persist they will force some producers to reduce their capital expenditures, especially the non-oil sands part of the industry that does not have much surplus cash flow to spare.

Oil Demand

China is highly consequential for oil markets, it consumes 13% of global supply and makes up about half of the annual growth each year. As well, its oil demand is more torqued to its GDP than western economies.

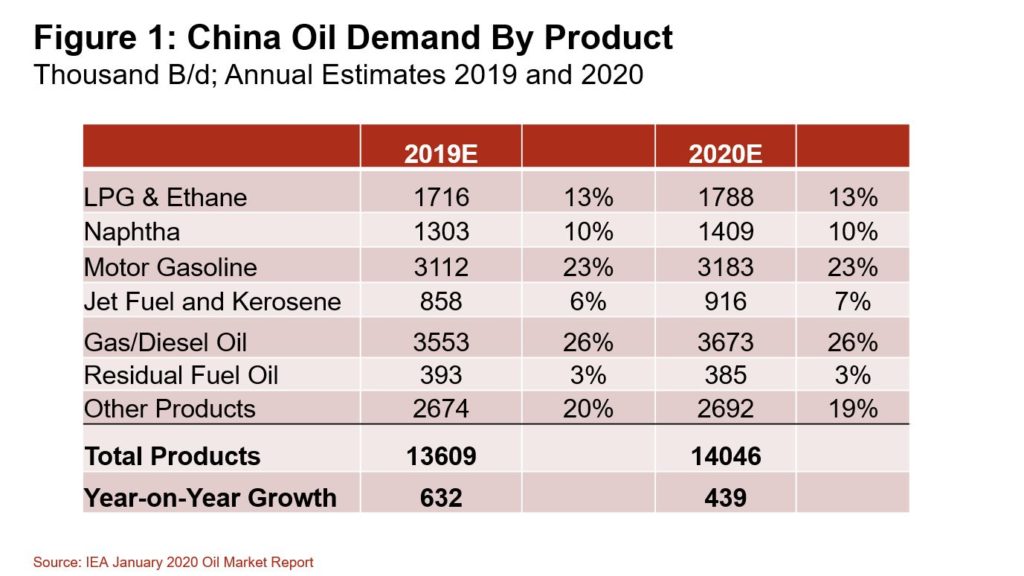

Figure 1 breaks Chinese oil demand into its components. At the start of the outbreak, the focus was on jet fuel which is a relatively small part of consumption. Now, as quarantine measures and travel restrictions widen, the virus is more likely to impact the broader economy, including the biggest parts of demand — motor gasoline and diesel.

Expert views on the impact to Chinese oil demand vary greatly, with some estimates that it is down by 3 MMB/d. What is certain is the actual numbers will be unknown for some time as Chinese oil demand can be opaque at the best of times.

The oil demand fallout from the Coronavirus is already radiating beyond China’s border. Major airlines from Europe, Asia, and North America have canceled all trips to mainland China. The impact is likely to spread from aviation into the broader economy. Especially considering that China is now the world’s second largest economy, accounting for 10% of the world’s goods imports.

Natural Gas Demand

Even before Coronavirus, global LNG markets were struggling. Japanese LNG prices averaged just below $US 6/MMBtu in 2019, a 40% discount to the average price a year prior.

China is a big player in the LNG markets. In 2018, it made up 17% of all global demand at 7 Bcf/d. Consumption is estimated to have increased by nearly 20% in 2019. Chinese LNG import growth was already expected to slow this year, Coronavirus could slow growth further. North America markets would not be immune, with the United States now exporting nearly 10 Bcf/d of LNG to global markets.

More Questions than Answers

For the next while, expect more questions than answers surrounding the extent of the Coronavirus and the impact on the economy, hence natural gas demand and oil consumption. What is becoming clear, however is that the event has the potential to test downside scenarios in 2020.