Commentary – Oilmageddon 2015: Episode Two

Source www.Dreamstime.com © Dreamstime.com

This global oil price war, now in its sixth month, has a James-Bond-like feel. A vulnerable, vital commodity is cloaked behind geopolitical intrigue, wars, sanctions, corruption, high-tech advancement and other unsettling factors.

What if some enterprising movie director was telling the oil price war story? The recent price run up is aimed to trick the audience; making them believe that the script is wrapping up. But the movie, titled Oilmageddon 2015, is not over yet. By any calculus the circumstances are now perfect for mischievous destabilization by price war commanders. The director is reading the following memo from his screenplay writers, explaining the latest episode in Oilmageddon’s plot:

Four months into 2015 and the actors in the oil price war are mostly succeeding in keeping the global price for oil below $60/B. Prices have risen in the last few weeks to the mid-$60 level, which is cause for some concern. Higher prices are a bit premature, but there is good reason to believe they won’t go higher. Battle-hardened commanders continue to try and pump barrels into the market to ensure an oversupply.

Regionally, oil prices in North America have been kept south of $60/B. For the protagonists this price is a satisfyingly destructive level for their assault against hydraulically fractured oils. Elsewhere, they are succeeding with their plan to strain cash flow in every global jurisdiction and starve the industry – and entire countries – of capital investment to their future benefit.

The commanders are still intent on targeting and destroying long-term output capacity from big oil megaprojects – those that require multi-billions in investment and take several years to build. By terminating such projects, they will be on track to create a global oil deficit three to five years out. At that time they will be in a position to substitute more of their own capacity to increase their market share at substantially higher prices. Of course oil demand is growing again (according to plan) so the timing will be perfect.

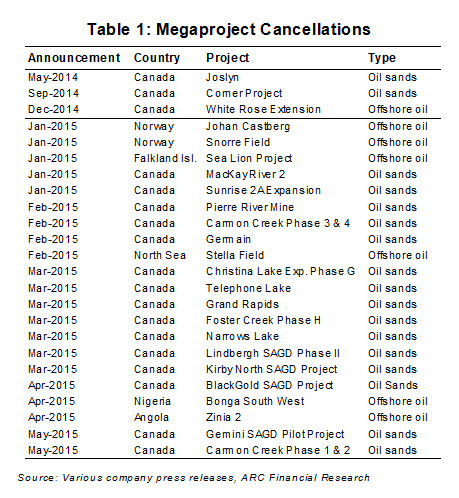

The tactical offensive to-date is also proceeding as planned. Since mid-2014, the casualty table (Table 1) shows the delay or cancellation of 24 oil megaprojects: 18 in Canada; two in Africa; three in Europe and one in South America. This is only a partial list. Not all companies are obliged to report their intentions. Inside intelligence suggests to the leaders that Table 1 could have at least a dozen or more names, recognizing that National Oil Companies are not forthcoming in disclosing their project cancellations.

The Canadian oil sands region, a troubling contributor to the oil glut over the past three years, is being hit hard by the price war campaign. Year-to-date, 15 projects have been delayed or cancelled representing a curtailment of 1.0 MMB/d of future production and at least $40 billion in investment. The commanders smile confidently that these oil sands projects have a low likelihood of ever coming back due to uncertain environmental and labour costs, as well as unknown fiscal policy. Canada’s oil sands output should flat-line near 3.0 MMB/d by the end of the decade, and fall well short of expectations by the early 2020s.

Beyond the oil sands, the North American theatre of operations is responding as expected. The US rig count is down over 50%. Canada’s winter drilling season was put on ice, and this summer is set to be one of the slowest for activity since 1999. It’s noted that higher prices will bring the rigs back; however ongoing layoffs in the service business will put a drag on the recovery.

Saudi Arabia is financially strong and able to take the price punch. However their treasury is now reporting monthly deficits after all general expenses. The costly war against Yemen is amplifying their deficit. Other Gulf producers in the region are also tight for cash and unhappy with the low price environment. However, it’s unlikely the upcoming June 5th OPEC meeting will bring cuts to the market. They are intent on winning this price war as much as the other adversaries in the fray.

The leaders of this offensive is reminded of some unexpected trends: despite low prices. American oil producers are arming themselves with large amounts of capital, in preparation for the price rebound. China is making friendship-for-barrels deals in South America, which has the effect of mitigating the near term financial pain from lost oil revenue. Price war commanders were hoping these actors would be among the first to show their open wounds, but they may have to wait longer now.

At the end of the episode, the leadership is advised to be patient. The stakes are high in the world oil trade: one percentage point of market share translates into almost $60 million per day at today’s prices. The proposed plan is to stay the course and try to keep the price of North Sea Brent under $65/B until at least the end of this year. The more near-term damage to supply sources, the greater the opportunity that emerges by 2018. Prices must not be allowed to come back too quickly otherwise this whole price war will have been all for naught.