Photo: Peter Tertzakian

Photo: Peter Tertzakian

Electric Vehicles are off to the Races

The age of electric vehicles, those quirky cars that have been perennially stigmatized as lacking range, reliability and affordability, is finally here. If you don’t believe that statement you probably haven’t driven one recently. Or attended a Formula E auto race. Or taken a look at some of the sales numbers.

Or all of the above.

For the first time in a century, the electric vehicle (EV) is on the road to becoming a serious competitive challenge to its petroleum nemesis. That’s not to say that the world’s billion-plus ‘conventional’ cars are ready to be dragged en masse to scrap yards with big cranes and magnets. Nor do a smattering of all-electric Teslas and BMWs suggest that the petroleum industry will easily surrender its headlock on the global transportation market. But at a minimum, today’s EV renaissance does strengthen the case that long-term forecasts for world oil consumption are overstated. And depending on the speed of technological advances in batteries and electric power trains, there are scenarios where EV adoption rates could surprise.

The most exciting place to witness EV advances is at an FIA Formula E racing event. All-electric Formula E (www.fiaformulae.com) is a newbie on the world racing circuit, but has attracted some of the same legendary names that have made its raucous Formula 1 cousin famous. For example, Williams Advanced Engineering is championing batteries; McLaren is involved with the motors; and founding partner Renault is integrating all the systems into sleek vehicles that look like mechanical doppelgangers for F1 racecars.

A couple of weekends ago I attended the first North American Formula E race, the Miami ePrix, held just north of Biscayne Bay. Lineups and shoulder-to-shoulder crowds amplified the sense that this fresh event was more than just about seeing who would spray champagne at the finish line. Teal colored banners everywhere reminded the crowds that they were there to “Drive the Future.”

Race time arrived. Four o’clock. The announcer called the drivers to their starting positions. No one else seemed to notice, but I smiled at the absence of the obviously antiquated, “Start your engines!” command. Suddenly, off the mark, ten cars lurched down the caged, 2.2 km circuit with tires squealing. And for the rest of the one-hour race that was it for loud noise. At every lap, the Formula E cars swished by with a satisfying, almost calming, smooth whine. Unlike a deafening Formula 1 race, a large part of the thrill was not having to silicone my ears shut.

Technological advances from the extreme engineering of the Formula E sphere will trickle down to mainstream cars, just as petroleum powered cars have benefited from seven decades of F1 racing. To be sure, electric power trains still need more work before mainstream EVs can be a compelling substitute for gas, gears and grease. But the race is on. EV sales figures from early laps of commercialization show that market penetration is worth a glance over the shoulder – especially if you’re driving for the oil team.

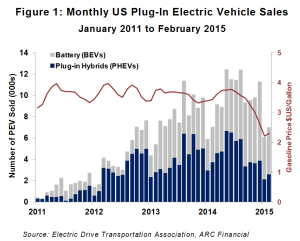

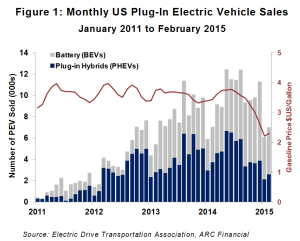

Our feature chart (Figure 1) this week gives an updated monthly sales snapshot of pure battery electric vehicles (BEVs) and plug-in hybrids (PHEVs). The latter still use a small gasoline-powered engine as a blanky for range, but primarily rely on a battery. Gasoline prices are overlain on the chart as a reference for the incumbent competition.

Adoption of EVs in the US market began a steady rise in 2011. Conditions were favourable when average gasoline prices were in the $3.75 to $4.00/gallon range. Sales numbers of almost 10,000 per month still pale compared to overall US auto sales of over a million a month; however it’s the uptrend of early adoption that’s noteworthy. Over the past six months US sales momentum appears to have fallen in tandem with gasoline prices; this is not surprising as there is less incentive for consumers to plug in when the price spread between the pump and the wall socket narrows. But like a race, it’s too early to call a downtrend. For one thing, don’t confuse adoption with seasonality: EV sales have traditionally had a dip during the winter months; 2014 and 2015 were especially harsh in the eastern US. Globally, sales of EVs – four wheeled and two wheeled varieties – are on an upswing in Europe and Asia. The International Energy Agency reports that there are now 230 million electric bikes in China. Global car sales (BEV and PHEV) are tracking 25,000 a month, and growing 50% per year if the trend line is extrapolated.

Diesel and gasoline powered cars will still have the pole position for many years to come. Nevertheless, the EVs are off to the races, quietly sneaking up on their competition.