Commentary – Room for Optimism (and Spending) in the Oil Sands

Source: www.Dreamstimes.com © Jewhyte

Despite the weak oil price, Canada’s oil sands will keep expanding. The milestones announced in today’s news demonstrate that fact, with Surmont 2 producing first oil and the next phase of Sunrise starting steaming operations. But do not be fooled into thinking that the oil sands are immune to the low oil price. They are just slower to react.

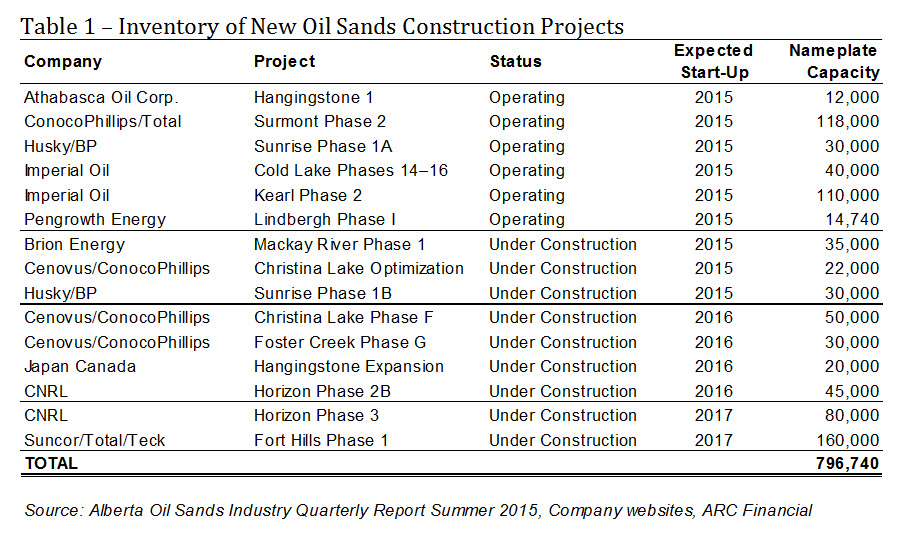

As part of the long-term investment style of oil sands mega projects, companies are required to lay down large sums of money three to four years before any oil is produced. As a result of final investment decisions that were made when oil price was higher, over 400,000 B/d of new oil sands capacity will start-up this year and almost 400,000 B/d more is due to start-up before 2018 (see Table 1). Since it typically takes a few years (and sometimes longer) for oil sands projects to approach their nameplate capacity levels, the current inventory of projects under construction practically guarantees oil sands growth for the next four to five years.

Despite the outlook for increasing production levels, oil sands are being hit by low oil price. In total, seventeen future oil sands projects have been delayed so far this year. But the full impact of these postponements will not be apparent until the latter part of this decade—when the investment in the current projects under construction ramps down and there is a void of new development following behind.

While most Albertans intuitively know that oil sands capital spending is a major engine of the provincial economy, most do not appreciate the magnitude. Over the past four years, capital projects in the oil sands have averaged $C 28 Billion per year. To put this in perspective, the Alberta government’s total annual budget is about $49 billion.

Broadly speaking, there are two types of capital investment. The first is spending on building brand new projects. The second expense type is spending to sustain the production levels of existing facilities, called sustaining capital. Examples of sustaining capital include replacing worn out equipment, drilling new in situ wells to offset the declines from older ones, or moving mining equipment closer to the ever moving mine face.

The amount of money spent on sustaining capital is surprisingly large. Oil sands producers spend between $C 8 and $C 12 of sustaining capital for each barrel of bitumen produced, and most companies are on the higher side of this range. Considering that the oil sands industry produced 2.1 MMB/d in 2014, sustaining capital expenses could be as high as $C 9 Billion or equal to a quarter of all capital spending that year.

So, considering the downturn, what is the outlook for oil sands capital spending? Because of the projects listed in Table 1, oil sands capital expenditures are likely to stay relatively high over the next three years—potentially near, or even higher than the $C 23 Billion of spending projected by CAPP in 2015. However, considering the long list of delayed projects announced so far this year, it is uncertain how much greenfield construction will follow behind these active projects.

Despite this uncertainty, there is still room for some optimism. Even if the construction of greenfield oil sands facilities slows to a trickle, expenditures on sustaining capital projects should remain robust. By the end of the decade, oil sands production is projected to reach 3 MMB/d, an output level that warrants as much as $C 13 Billion per year of sustaining capital spending. While this is a markdown from recent spending levels, it is still a considerable sum and greater than all of the oil and gas capital spending in British Columbia and Saskatchewan combined.

Let’s not fool ourselves, the growth of the oil sands is slowing. However, by the end of the decade oil sands production will be substantial, greater than the current production of Iran or Kuwait. Just to sustain this production level requires a substantial amount of investment, spending that will generate jobs and economic benefits for Alberta and Canada for many years to come.

Message from Peter Tertzakian:

As many of you know, I was appointed to the Alberta Royalty Review Panel last week. It’s an honour to serve my Province in this important task. To focus on the review, and to ensure objectivity, I will be taking a leave from writing ARC Energy Charts until the review is finished in December. In the meantime, the ever capable Jackie Forrest will be publishing commentary as time allows. As always, thank you to all our readers for their ongoing interest in our work. – Peter Tertzakian