SnapChart – All Eyes on Vienna

Oil market watchers of all types are awaiting the outcome of this Thursday’s OPEC meeting. And there are several reasons why they should be anxious. Despite recent improvements in oil market fundamentals and price (WTI oil prices are up about 20 percent since the last Vienna assembly), the outcome of the November 30th meeting will be significant in signaling what the world oil market may look like in 2018.

Pillars of improving oil market fundamentals include: strengthening global oil demand, which is now estimated to grow by 1.5 MMB/d in 2017 and 1.3 MMB/d in 2018; and declining OECD crude oil inventories (the surplus to the five year average has been cut by more than half since the start of the year, from over 300 MMB to under 120 MMB). [1] A geopolitical risk premium has also re-emerged with Middle Eastern tensions on the rise (see our recent commentary).

Despite these price-firming fundamentals, and even assuming an extension to the OPEC/Russian production pact, the market could remain well supplied next year owing to growth from non-cartel producers, including the United States, Canada, and Brazil. Under a bearish scenario whereby Thursday’s talks break down, greater-than-expected OPEC and Russian production next year would flip the market outlook from tenuous balance, to oversupply.

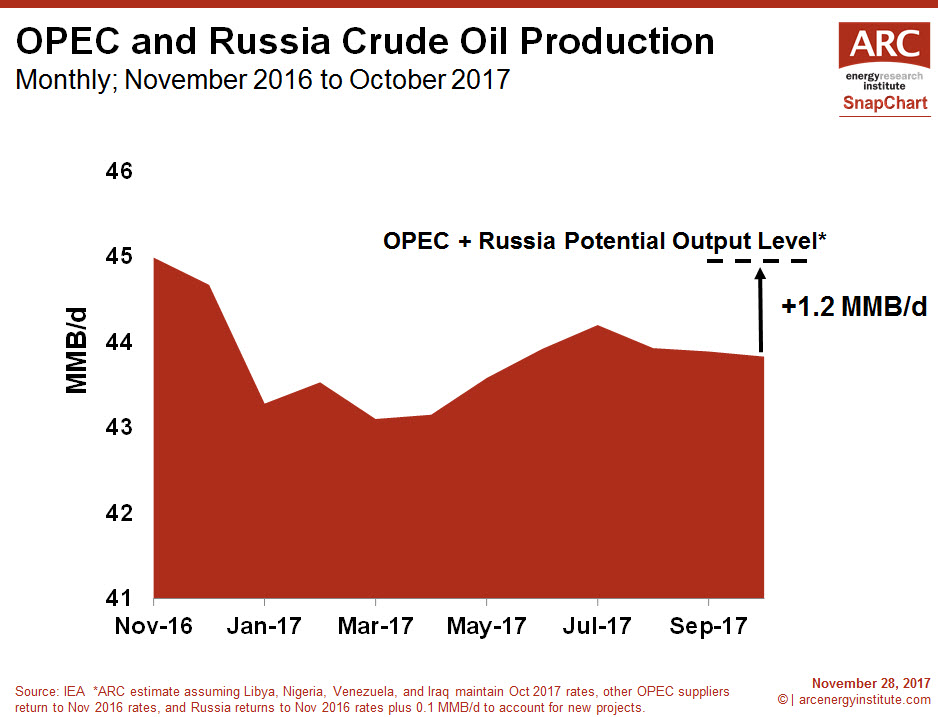

This week’s ARC SnapChart plots the combined production of OPEC and Russia, relative to the record high output last November (before the production cuts took hold). Our chart also plots the potential output of the group under a scenario where the production cuts are abandoned.

Assuming that, with the exception of the more challenged cartel members (Libya, Venezuela, Nigeria and Iraq), other producers return to November 2016 output levels and Russia pushes slightly higher from new investment, than the result could be 1.2 MMB/d of additional production. That new supply would decidedly weigh down the recent oil price gains.

Assuming that, with the exception of the more challenged cartel members (Libya, Venezuela, Nigeria and Iraq), other producers return to November 2016 output levels and Russia pushes slightly higher from new investment, than the result could be 1.2 MMB/d of additional production. That new supply would decidedly weigh down the recent oil price gains.

Thursday’s meeting will set an anxious tone.

[1] IEA Oil Market Report, November 2017.