SnapChart – Canadian Crude-by-Rail on Track to Increase

Western Canadian oil production is bumping up against pipeline capacity. The resulting glut is causing a discount for Canadian oils. Heavy grades are pricing about $US 10/B under normal, while light oil prices have been less impacted, selling nearly $US 2/B cheaper. (1)

The price dislocation is the result of growing oil sands supply. Because of investment decisions that were made prior to the 2014 downturn, over 300,000 B/d of new oil sands facilities are currently finishing up construction and starting to produce first oil. Meanwhile, pipeline capacity – which has been extensively debottlenecked and optimized over the past few years – has hit the limits for moving any more barrels.

Over the next few years, new pipelines are expected to solve the problem. (2) In the interim, growing oil sands production will be transported by rail car using established rail loading facilities. Western Canada has over 750,000 B/d of infrastructure already in place.

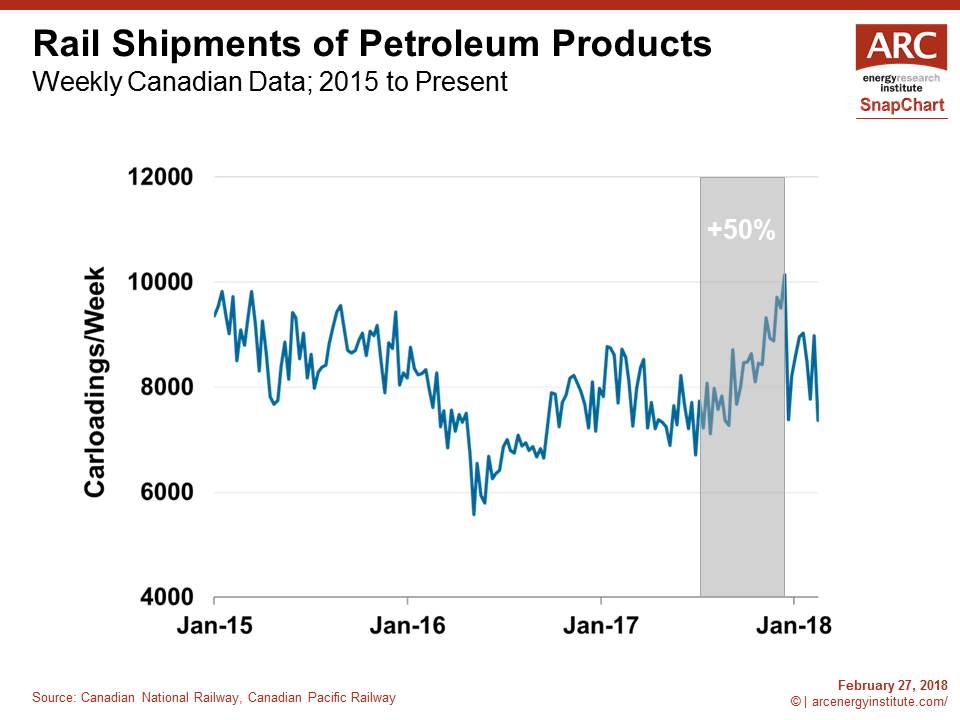

Today’s SnapChart plots Canadian rail shipments of petroleum products (including refined products and crude oil). Going forward, this chart will be updated weekly and included in our ARC Energy Charts publication (Chart 9).

The SnapChart shows that petroleum loadings ramped up 50 percent in the second half of 2017 (a gain that is equivalent to about 90,000 B/d of crude oil). However, so far this year rail loadings have been trending down. One cause has been extremely cold winter weather that has hampered railroad operations.

The SnapChart shows that petroleum loadings ramped up 50 percent in the second half of 2017 (a gain that is equivalent to about 90,000 B/d of crude oil). However, so far this year rail loadings have been trending down. One cause has been extremely cold winter weather that has hampered railroad operations.

But with spring right around the corner, a strong economic incentive from price discounts, and growing oil sands production, Canadian petroleum shipments are set to increase.

As new data is available each week, we will be monitoring rail activity in our Energy Charts publication. Petroleum shipments will be an important metric to watch going forward, since increasing rail volumes are a signal that Western Canadian price discounts will start to narrow.

(1) The price discount to market normal is estimated by ARC, comparing the current pricing to a normalized differential that reflects pipeline transportation costs and quality differences.

(2) There are three Canadian projects progressing towards construction, which together would provide a combined capacity expansion of over 1.5 MMB/d. Enbridge’s Line 3 Replacement is expected to go into service in the second half of 2019. TransCanada’s Keystone XL could start construction as early as 2019, and Kinder Morgan’s Trans Mountain Expansion Project is still progressing; however, timing is still uncertain due to British Columbia’s opposition to the project.