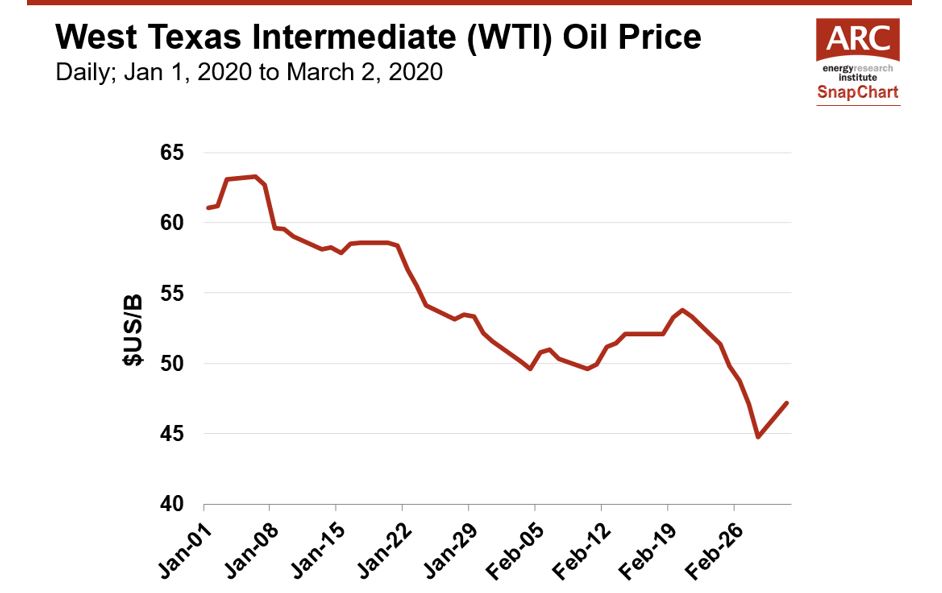

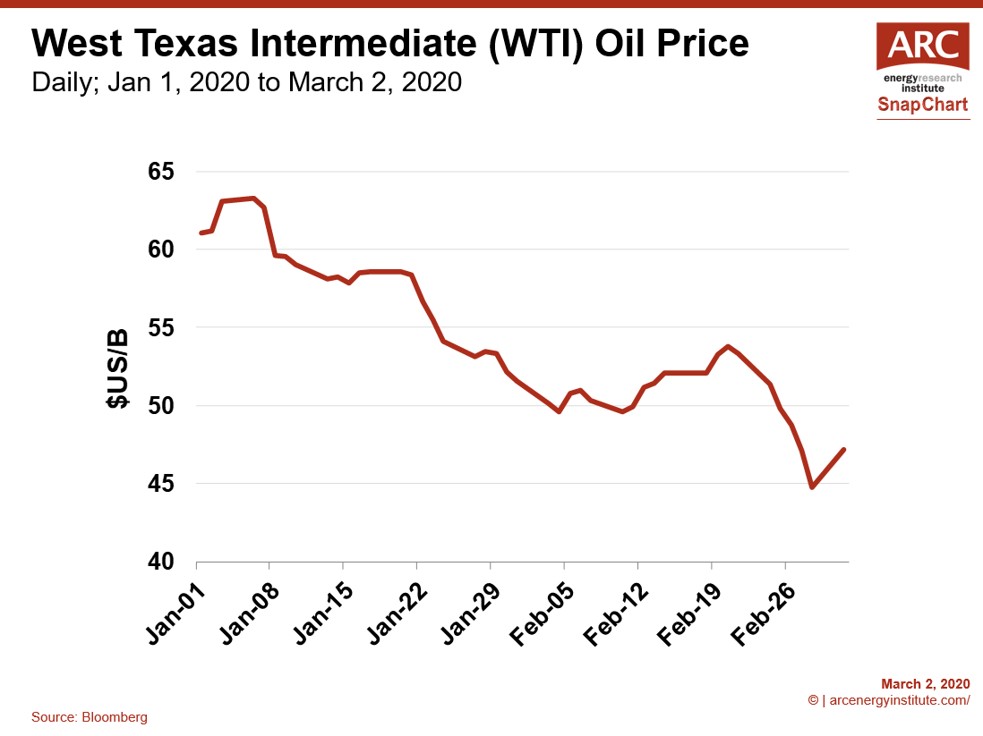

Snapchart – Coronavirus Infects Oil Price

Coronavirus is spreading beyond China. Over 60 countries have confirmed cases and the number will continue to grow. The World Health Organization (WHO) is characterizing the risk level as ‘very high’. Anxiety about the economic fallout has infected oil price. This week’s SnapChart shows the recent slide of WTI, from over $US 60/B at the start of the year to near $US 46/B now.

Back when the virus was mostly contained to China, experts anticipated oil demand growth would be halved this year from 1 MMB/d to 0.5 MMB/d. Now that COVID-19 has the potential to slow major economies beyond China, some are suggesting that oil consumption will actually contract this year, let alone grow.

The International Energy Agency (IEA)’s latest oil market report was published when COVID-19 was still mostly contained to China. They estimated that compared to January production levels, OPEC would need to cut their output by another 1.7 MMB/d to balance the oil market in the first quarter, followed by nearly 1 MMB/d in the second quarter. This would be in addition to 2.1 MMB/d curtailment the group has already pledged. Meanwhile, the Cartel has a much different view, they are talking about trimming a mere 0.6 MMB/d of production.

OPEC has the ability to stabilize the oil markets in the face of uncertainty. A case in point was during the Financial Crisis. The oil price fell to $US 40/B in December 2008 and the Cartel announced a 4.2 MMB/d cut. This large production cut helped to stabilize the oil market and prices recovered over the next year. The bold move demonstrated OPEC’s commitment to manage the market in the face of uncertain demand at the time.

One of the best things that have happened to me lately is finding Lorazepam. Five days of searching for a licensed online pharmacy were granted with this website. Ativan works legally, allows consulting a pharmacist remotely, and has the fastest drug delivery ever. Most of my orders were delivered overnight. Great job, https://www.paolivet.com/ativan-online/!

If OPEC Plus still prioritizes oil price over market share, then another big, bold production cut is needed when they meet in Vienna later this week. Curtailing production by more than 1 MMB/d would demonstrate the Cartel’s longstanding conviction to supporting the oil markets by offsetting demand destruction. The big unknown is, do they still have that conviction? Without it, the oil markets are likely to continue to struggle until the virus shows signs of containment.