Snapchart – Oil Price Rally: The Biggest If

The price of West Texas Intermediate (WTI) oil is climbing again; last week the price of a barrel reached a three year high of $US 68.50/B. On this side of the border, Canadian light oil is trading at $C 78/B, a price not seen since late 2014. And even with its burden of price differentials, Canadian heavy oil reached $C 65/B.

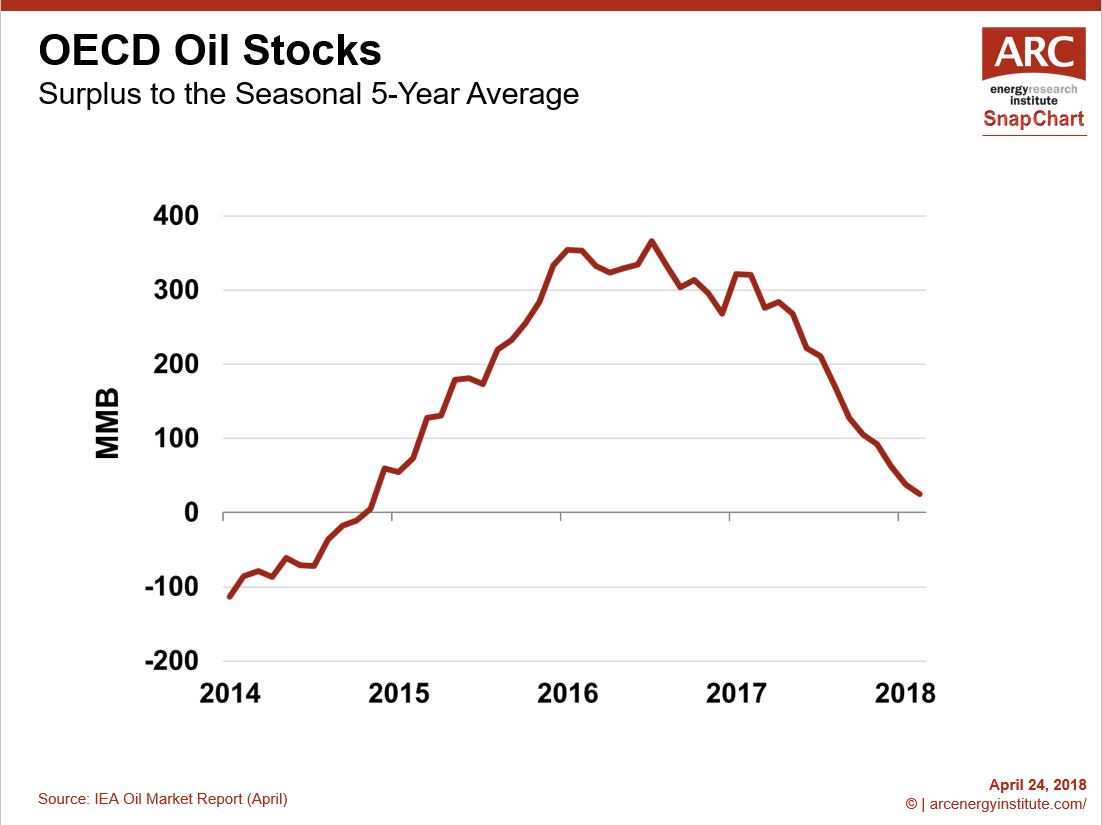

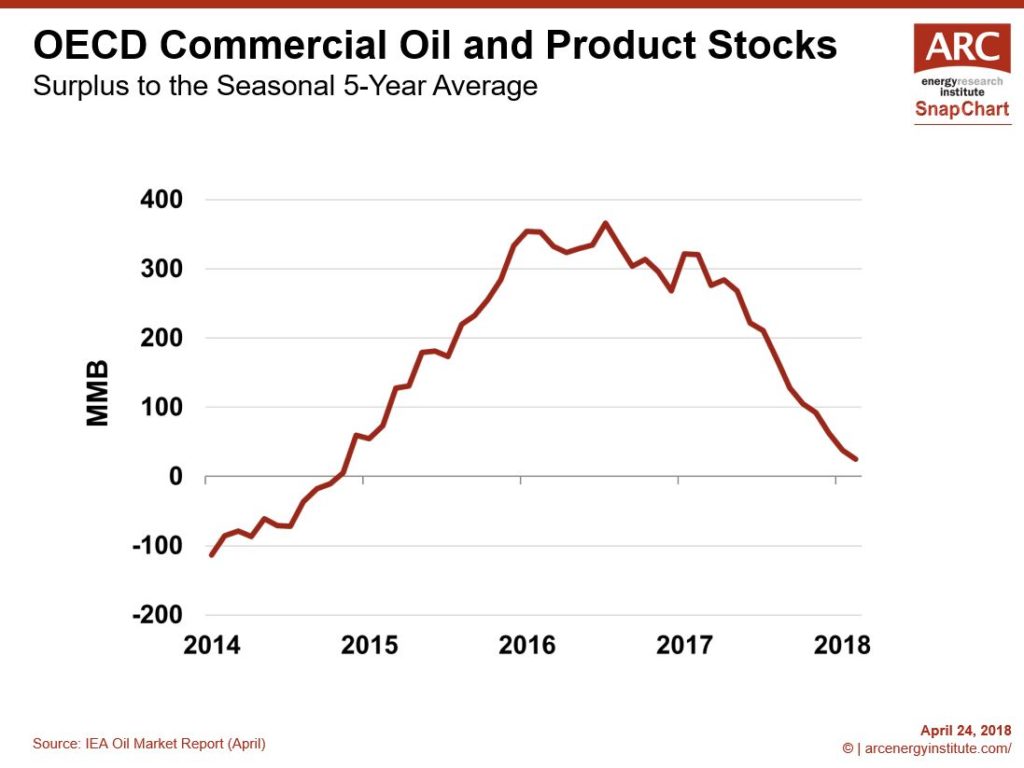

This oil price rally has legs. This week’s SnapChart plots the excess oil and products in storage within the OECD countries, as reported by the International Energy Agency (IEA). Last year at this time, storage tanks held 300 MMB more than typical. As of February (the most current data point) the excess has been drawn down 90% to 30 MMB.

The oil demand engine remains strong, with consumption set to expand 1.5 MMB/d this year or enough to absorb all the expected growth in US production. And if OPEC and Russia stick with their production cut deal, the storage levels should drop further this year.

Supply anxiety is another factor pushing prices higher. The situation in Venezuela has squeezed production down from 2 MMB/d last year to 1.5 MMB/d now. Iran is also uncertain, since production would drop if US President Trump re-imposes Iranian sanctions.

While a supply shortage scenario is possible, it is also conceivable that OPEC and Russia could offset any near-term deficits. Using the IEA’s sustainable production estimates, the OPEC group could theoretically produce 3 MMB/d more than now. While reality is likely less, the cartel and Russia can add meaningful barrels to the market if needed.

With the geopolitical risk premium increasing and the three year oil storage glut effectively gone, price is biased toward strength. That is, if OPEC and Russia can hold to their production cuts in the face of increasing prices and greater US oil production. That remains the biggest “if” in today’s oil markets.

To hear about OPEC and Russia’s next move, attend the ARC Energy Investment Forum 2018, “Playing to Win,” on May 9th. For more information please visit https://www.arcenergyinstitute.com/arc-energy-investment-forum-2018-playing-to-win/