Commentary – Look Out for More Belt Tightening Next Year

Headcount reductions, wage roll backs and project cancellations—the surge of bad oil patch news keeps coming. To many workers in the Canadian oil patch, 2015 cannot be over soon enough.

But at this point, 2016 is looking like it will be another challenging year. Natural gas prices are at near record lows, and oil markets remain stubbornly over supplied. Add to the mix that it is difficult (if not impossible) for public companies to raise new equity, and the cost of debt is increasing.

Low commodity prices have stressed the oil and gas industry’s finances. Canadian oil and gas industry revenue is likely to finish 2015 almost 40% below last year, dropping to $C 91 Billion—an amount similar to the level seen during the financial crisis of 2009. Industry cash flow (the money left after revenue is used to pay all the bills including operating expenses, overhead, royalties and taxes) will also be skinny, coming in at $C 27 Billion, about 25% below the level in 2009 and the lowest amount in 13 years.

Industry cash flow matters. It is the main source of capital for drilling wells and building new facilities. Even though the industry has made drastic cuts to capital spending in 2015 (48% year-on-year for non-oil sands and 33% for oil sands producers), companies are still outspending their cash flows. In order to finish off large megaprojects, oil sands producers will spend about 2.2 times their cash flows in 2015, while non-oil sands producers will spend over 1.4 times their cash flows.

Without enough cash to fund all of their new capital projects this year, the industry requires other sources of capital. While some larger oil companies have more funding options (including cash flow from international or downstream operations), most of the extra funds come from external capital (debt and public equities).

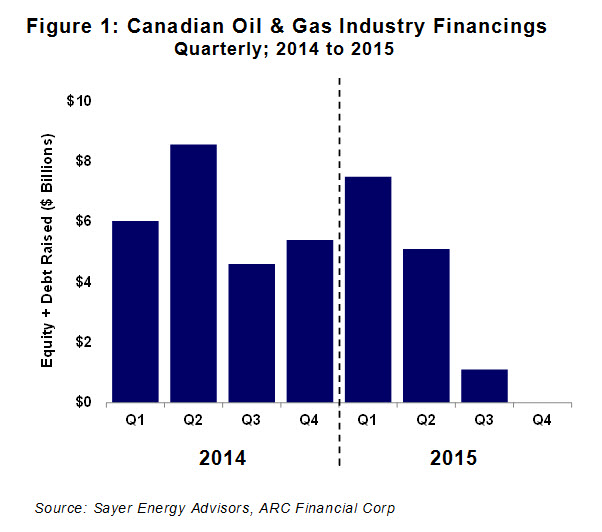

Canadian oil and gas companies were relatively successful in raising external capital in the first half of the year. According to Sayer Energy Advisors, the industry raised over $C 12 billion of external capital, a figure that was just 15% below the same period in 2014. However, after a strong showing at the start of the year, the flow of external capital declined to a trickle in the third quarter, with just over $C 1 billion raised (see Figure 1). Even when you include the over $C 1 billion of equity raised by PrairieSky this week, the fourth quarter of 2015 is looking to be on par with last quarter. However, PrairieSky is a reminder that while the overall market is challenged there are some exceptions.

Considering that capital is scarce, producers will need to tighten up their belts even more next year. In a scenario where non-oil sands producers can only spend their cash flows and commodity prices remain fairly flat, capital spending would be cut in the range of 10 to 20% next year. However, this gloomy outlook is highly sensitive to commodity price and expense assumptions. If you assume the oil price is higher next year (either because of a price recovery or from hedging), then the industry would spend more. By the same token, if companies can further reduce operating and other administrative expenses, this will free up more cash for re-investment.

While scenarios for equal or even higher spending next year are possible, the oil patch is not betting on it. So far, most companies that have announced their 2016 budgets are cutting, and as more companies release third quarter results, a broader perspective on next year’s spending will come into view.

For the oil sands, the majority of capital is being spent on finishing up near term projects. Almost 400,000 barrels per day of new projects are due to come online in 2016 and 2017, and because these projects require billions in spending, oil sands companies are expected to continue to outspend their cash flows well into next year. While cancellation of projects at this late stage seems unlikely, a reduction in year-on-year spending is expected for two reasons. First, price discounts for equipment and services mean less spending for the same outcome. And second, low commodity prices and a shortage of capital could force some companies to slow down the pace of construction.

The external capital shortfall highlights the grim reality that, even with the meaningful reduction in industry costs over the past 12 months, more cost cutting is needed. Capital scarcity has other implications too, as it could accelerate the pace of merger and acquisition activity. For many companies, selling properties is one of the only remaining options for raising capital.

With an uncertain commodity price environment and a lack of capital, 2016 is looking like another tough year for oil patch companies and workers. But take comfort in the fact that the companies that survive this downturn will emerge stronger and leaner, giving them a significant leg up when prices do recover.