Commentary – A Challenging First Quarter

Produced by Peter Tertzakian | by Peter TertzakianChief financial officers of Canada’s oil and gas industry will close their ledgers today and prepare to report on the first quarter of 2015. Their numbers will be grim. Read more

Commentary – Electric Vehicles are off to the Races

Produced by Peter Tertzakian | by Peter TertzakianElectric Vehicles are off to the Races

The age of electric vehicles, those quirky cars that have been perennially stigmatized as lacking range, reliability and affordability, is finally here. If you don’t believe that statement you probably haven’t driven one recently. Or attended a Formula E auto race. Or taken a look at some of the sales numbers.

Or all of the above.

For the first time in a century, the electric vehicle (EV) is on the road to becoming a serious competitive challenge to its petroleum nemesis. That’s not to say that the world’s billion-plus ‘conventional’ cars are ready to be dragged en masse to scrap yards with big cranes and magnets. Nor do a smattering of all-electric Teslas and BMWs suggest that the petroleum industry will easily surrender its headlock on the global transportation market. But at a minimum, today’s EV renaissance does strengthen the case that long-term forecasts for world oil consumption are overstated. And depending on the speed of technological advances in batteries and electric power trains, there are scenarios where EV adoption rates could surprise.

The most exciting place to witness EV advances is at an FIA Formula E racing event. All-electric Formula E (www.fiaformulae.com) is a newbie on the world racing circuit, but has attracted some of the same legendary names that have made its raucous Formula 1 cousin famous. For example, Williams Advanced Engineering is championing batteries; McLaren is involved with the motors; and founding partner Renault is integrating all the systems into sleek vehicles that look like mechanical doppelgangers for F1 racecars.

A couple of weekends ago I attended the first North American Formula E race, the Miami ePrix, held just north of Biscayne Bay. Lineups and shoulder-to-shoulder crowds amplified the sense that this fresh event was more than just about seeing who would spray champagne at the finish line. Teal colored banners everywhere reminded the crowds that they were there to “Drive the Future.”

Race time arrived. Four o’clock. The announcer called the drivers to their starting positions. No one else seemed to notice, but I smiled at the absence of the obviously antiquated, “Start your engines!” command. Suddenly, off the mark, ten cars lurched down the caged, 2.2 km circuit with tires squealing. And for the rest of the one-hour race that was it for loud noise. At every lap, the Formula E cars swished by with a satisfying, almost calming, smooth whine. Unlike a deafening Formula 1 race, a large part of the thrill was not having to silicone my ears shut.

Technological advances from the extreme engineering of the Formula E sphere will trickle down to mainstream cars, just as petroleum powered cars have benefited from seven decades of F1 racing. To be sure, electric power trains still need more work before mainstream EVs can be a compelling substitute for gas, gears and grease. But the race is on. EV sales figures from early laps of commercialization show that market penetration is worth a glance over the shoulder – especially if you’re driving for the oil team.

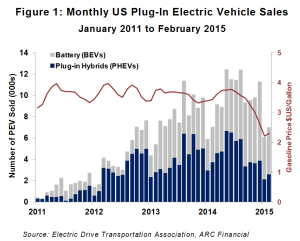

Our feature chart (Figure 1) this week gives an updated monthly sales snapshot of pure battery electric vehicles (BEVs) and plug-in hybrids (PHEVs). The latter still use a small gasoline-powered engine as a blanky for range, but primarily rely on a battery. Gasoline prices are overlain on the chart as a reference for the incumbent competition.

Adoption of EVs in the US market began a steady rise in 2011. Conditions were favourable when average gasoline prices were in the $3.75 to $4.00/gallon range. Sales numbers of almost 10,000 per month still pale compared to overall US auto sales of over a million a month; however it’s the uptrend of early adoption that’s noteworthy. Over the past six months US sales momentum appears to have fallen in tandem with gasoline prices; this is not surprising as there is less incentive for consumers to plug in when the price spread between the pump and the wall socket narrows. But like a race, it’s too early to call a downtrend. For one thing, don’t confuse adoption with seasonality: EV sales have traditionally had a dip during the winter months; 2014 and 2015 were especially harsh in the eastern US. Globally, sales of EVs – four wheeled and two wheeled varieties – are on an upswing in Europe and Asia. The International Energy Agency reports that there are now 230 million electric bikes in China. Global car sales (BEV and PHEV) are tracking 25,000 a month, and growing 50% per year if the trend line is extrapolated.

Diesel and gasoline powered cars will still have the pole position for many years to come. Nevertheless, the EVs are off to the races, quietly sneaking up on their competition.

Commentary – The Nature of the Oil Beast

Produced by Peter Tertzakian | by Peter Tertzakian

Source: www.Dreamstime.com © Beehler

Nature shows can be troubling. We’ve all seen the imagery. Hobbling wildebeest on the African savannah dying off during a drought. Meanwhile, dispassionate lead animals barely glance back at the weak. Resolute and disciplined, the strong march on to their watery destination, becoming stronger through their pain.

The corporate savannah known as the “oil patch” was displaying its own version of Darwinism last week. Weak companies, emaciated by a drought of capital were beginning to succumb to market death. Blue-suited bankers were making their moves, stalking companies lean on cash and fat on debt. Meanwhile, mighty ExxonMobil, the fit leader of the migrating herd, announced that things would be tough for a while yet, but that it will adapt, survive and even thrive under today’s parched oil prices.

Yes, there are dark clouds looming ahead in the land called the oil patch. But these clouds are not bearing rain – just more trouble.

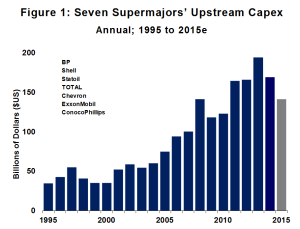

Few are as strong as ExxonMobil, which despite its resilience only supplies the world with 2.3% of its 93 million barrel-a-day addiction. And even it is going to husband its capital during this downturn; Chairman and CEO Rex Tillerson announced a $34 billion capital budget for 2015, down 12% from last year. It doesn’t sound like much among the big and mighty, but it’s the collective capital cuts by the whole multinational pack that’s notable (see Figure 1).

Relative to 2014, multinational upstream capital expenditures will be down by $28 billion this year. But it’s the comparison to the 2013 peak that makes the cuts by this group-of-seven look stingy. Relative to two years ago, their 2015 spending will be down by $53 billion, or 27%. These are just dull numbers today, but those with elephant memories will think back to this penny-pinching behaviour in a few years, when world oil supply struggles to keep pace with consumption.

Relative to 2014, multinational upstream capital expenditures will be down by $28 billion this year. But it’s the comparison to the 2013 peak that makes the cuts by this group-of-seven look stingy. Relative to two years ago, their 2015 spending will be down by $53 billion, or 27%. These are just dull numbers today, but those with elephant memories will think back to this penny-pinching behaviour in a few years, when world oil supply struggles to keep pace with consumption.

In our world of instant gratification, the multi-year lag between spending money and pumping oil is not fully appreciated. Much of the world’s oil production additions over the next few years will accrue from the ramp up in spending that took place during the period of plentiful capital, between 2011 and 2013.

From their March 4th news release, ExxonMobil’s 2015 on-stream project list reads like a National Geographic Atlas: “Hadrian South in the Gulf of Mexico, expansion of the Kearl Project in Canada, Banyu Urip in Indonesia and deepwater expansion projects at Erha in Nigeria and Kizomba in Angola.” In 2016 and 2017, new oil and gas production will come from Australia, Eastern Canada, the United Arab Emirates and far east Russia. All of this global iron is impressive, but ExxonMobil’s megaprojects are exactly the type that other oil companies have been axing over the past 18 months. In fact, Statoil delayed another two of its offshore projects – Johan Castberg and Snorre – in the North Sea last week.

Being big on the savannah doesn’t correlate to being strong. Oil production from the seven largest multinationals peaked in 2006 at 12.5 MMB/d. Today, almost 10 years hence, their oil output is down by a fifth to 10.1 MMB/d. That’s hardly called growth – especially after spending $1.3 trillion over the same period. Natural gas has been more of a source of growth for the group, but even that’s been faltering lately.

So, what does all this say about other, sore-hoofed international oil producers that are trying to march on in a sandstorm of sanctions, corruption, civil war, insurgency, anarchy and now capital starvation? A top Russian oil executive expects Russian oil production to fall 800,000 b/d by the end of 2016. Libya is self-destructing. Many parts of Iraq are in chaos. Venezuela is teetering on default. Nigeria has cancerous militants encroaching from the north. The list of the weak goes on. But due to low oil price, these five countries that pump out over 20% of the world’s oil production will generate approximately $300 billion less in revenue this year. In short, the world of oil outside North America is a big mess that’s in the early stages of chronic instability. No wonder multinationals are paring back their spending and rationing their capital toward the only place that has shown any stability and growth in the past five years: the United States and Canada, where the unique species of entrepreneurial independents graze on tight oil.

ExxonMobil’s chief said last week that markets should “settle in” for a period of oil prices around this level – in other words $50 a barrel. But to “settle in” at these levels is unsettling. In the wild kingdom of the oil patch, today’s capital drought looks like it’s leading to tomorrow’s supply drought.

Contact Information

4300 – 400 3rd Ave S.W.

Calgary, AB

T2P 4H2

Direct Phone: (403) 292 – 0680

An Integral Part of ARC Financial Corp.

Join Our Newsletter

Recent Podcasts

Why I Hate S-Curves: An Interview with Rob West from Thunder Said EnergySeptember 10, 2024 - 2:42 pm

Why I Hate S-Curves: An Interview with Rob West from Thunder Said EnergySeptember 10, 2024 - 2:42 pm Summer 2024 Energy News Wrap-UpSeptember 3, 2024 - 1:59 pm

Summer 2024 Energy News Wrap-UpSeptember 3, 2024 - 1:59 pm A Conversation with Nancy Southern, Chair & CEO of ATCOJuly 16, 2024 - 4:27 pm

A Conversation with Nancy Southern, Chair & CEO of ATCOJuly 16, 2024 - 4:27 pm